Sometimes, a single slide can explain more than a long report. Points and Figures is our way of breaking down what India’s leading companies are telling their shareholders and analysts. We comb through the decks, pull out the charts and data points that actually matter, and highlight the signals behind the numbers—whether about growth plans, margins, new markets, or risks on the horizon.

This is an extension of The Chatter. While The Chatter focuses on management commentary and earnings call transcripts, Points and Figures dives into investor presentations—and soon, even annual reports—to decode what companies are showing, not just what they're saying.

We go through every major investor presentation so you don’t have to—bringing you the sharpest takeaways that reveal not just what the company is saying, but what it really means for the business, its sector, and the broader economy.

In this edition, we have covered 29 companies across 15 industries

Auto & Auto Ancilliary

Tata Motors

M&M

Samvardhana Motherson

Aviation

Indigo

FMCG

Varun Beverages

Globus Spirits Ltd

Piccadily Agro Industries Ltd

Godfrey Phillips India Ltd

Patanjali Foods

Metals

Hindalco Industries Ltd

Vedanta

Financial Services

Arman Financial Services Ltd

SBI Cards & Payment Services Ltd

Bajaj Finserv

Media & Entertainment

Saregama India Ltd

Diversified

Grasim Industries Ltd

Tourism & Hospitality

ITC Hotels Ltd

Software Services

L&T Technology Services

Firstsource Solution

Retail

Titan Company Ltd

Kalyan Jewellers India Ltd

Energy

Reliance Industries Ltd.

NTPC

Adani Power

Textiles

Monte Carlo Fashions

Fertilizer

Khaitan Chemicals & Fertilizers Ltd.

Healthcare

Sun Pharma Inds.

Max Healthcare Institute Ltd

Consumer Durables

Eureka Forbes

Tata Motors | Large Cap | Auto Ancillary

Tata Motors is a global automobile manufacturer known for cars, utility vehicles, pick-ups, trucks, and buses. With a focus on e-mobility solutions and innovation, it leads India's commercial vehicles market and ranks highly in passenger vehicles.

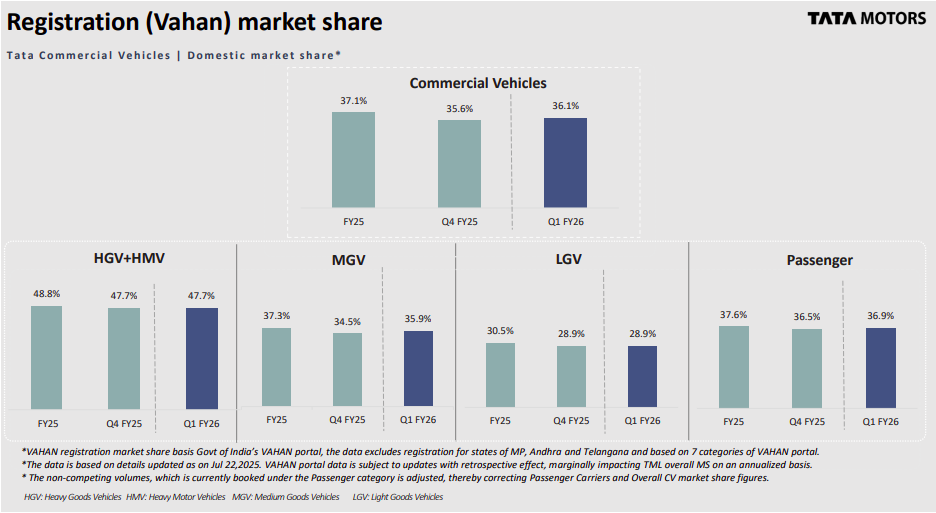

Tata Motors' domestic market share shows interesting trends across categories. In Commercial Vehicles, share slipped from 37.1% in FY25 to 35.6% in Q4 FY25, before recovering to 36.1% in Q1 FY26. HGV+HMV remained steady at ~47.7–48.8%, while MGV dipped from 37.3% to 34.5% but rebounded to 35.9%. LGV weakened from 30.5% to 28.9%, whereas the Passenger segment stayed stable at ~36.5–36.9%. Strength in heavy vehicles contrasts with pressure in medium and light segments.

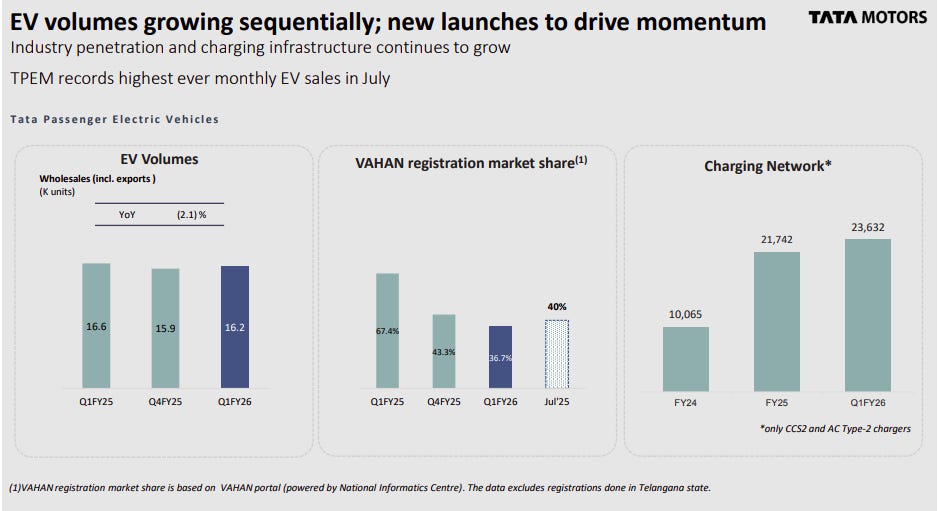

Tata Motors EV sales hit record highs in July; VAHAN share climbs to 40% as charging infra crosses 23K stations.

M&M | Large Cap | Auto Ancillary

Mahindra & Mahindra Limited (M&M) is a prominent Indian automobile manufacturing company known for its wide range of mobility products and farm solutions. With a history dating back to 1947, M&M has established itself as a leading player in the industry by offering SUVs, pickups, commercial vehicles, tractors, electric vehicles, two-wheelers, gensets, and construction equipment.

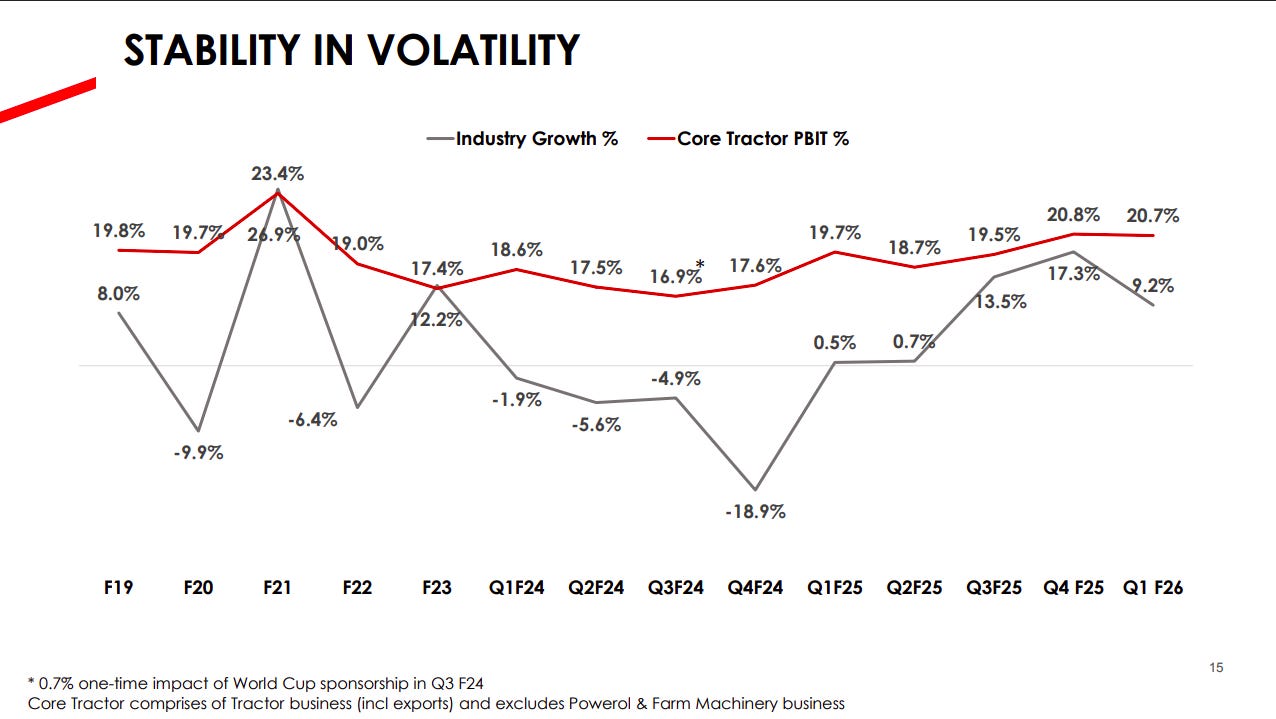

Despite industry swings, M&M’s core tractor PBIT stayed resilient at ~20.7% in Q1 FY26, highlighting strong margin stability versus sector volatility.

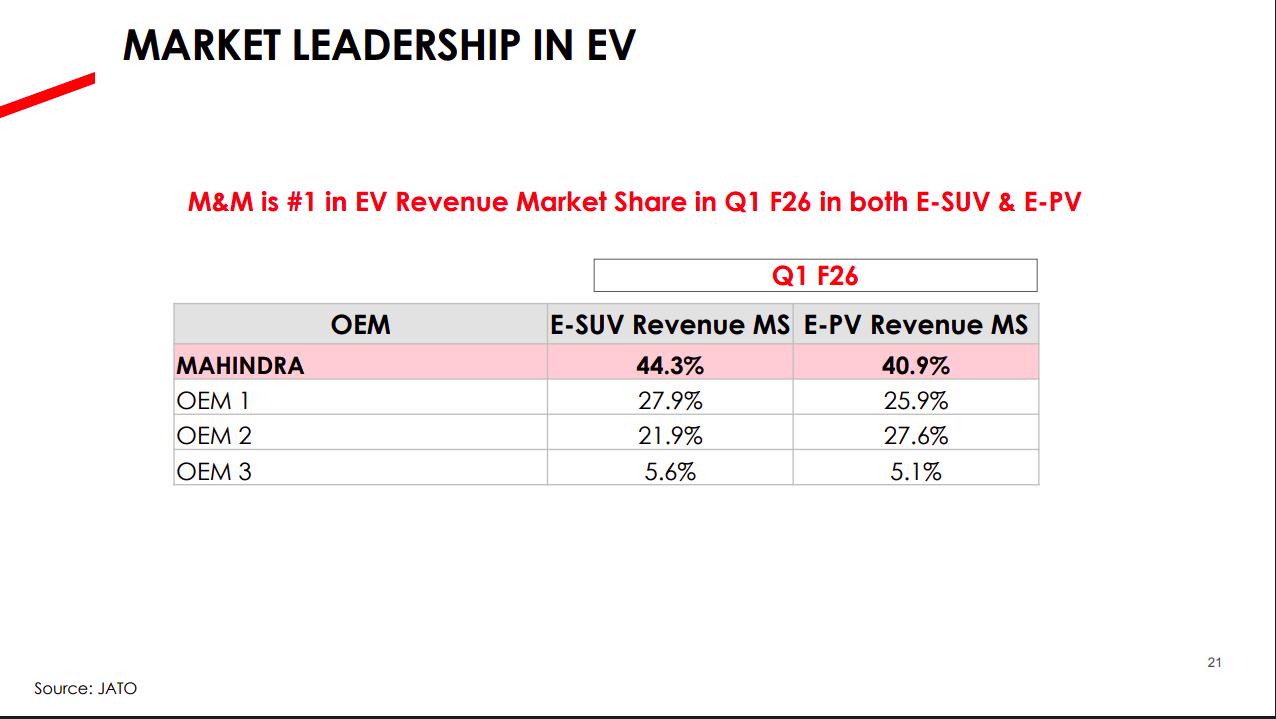

M&M leads EV revenue market share in Q1 FY26 with 44.3% in E-SUVs and 40.9% in E-PVs, well ahead of peers (next OEMs at ~22–28%)

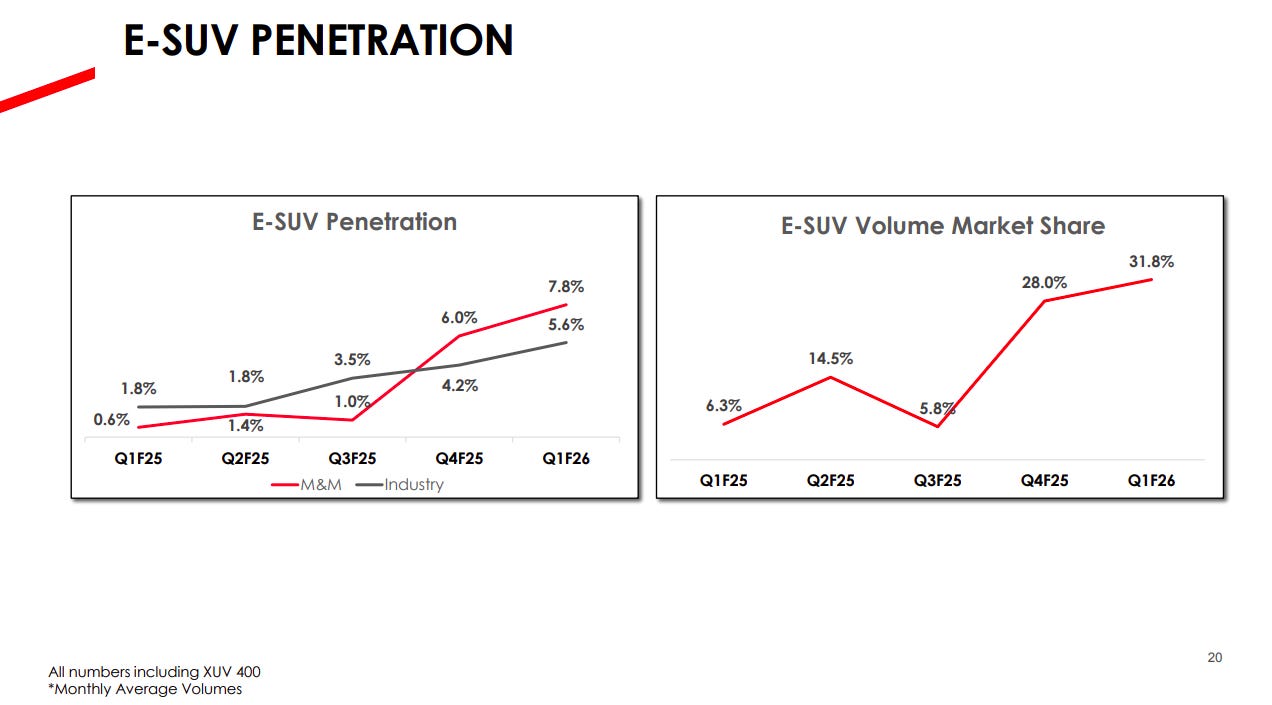

M&M’s E-SUV penetration surged to 7.8% in Q1 FY26, ahead of industry’s 5.6%, while its E-SUV volume market share hit 31.8%, up sharply from 6.3% a year ago.

Indigo | Large Cap | Aviation

InterGlobe Aviation is a company operating in the aviation industry in India, specializing in low-cost carrier (LCC) services. Their primary activities include air transportation for passengers and cargo, along with providing associated services such as in-flight sales, aircraft maintenance engineering, and advanced pilot training.

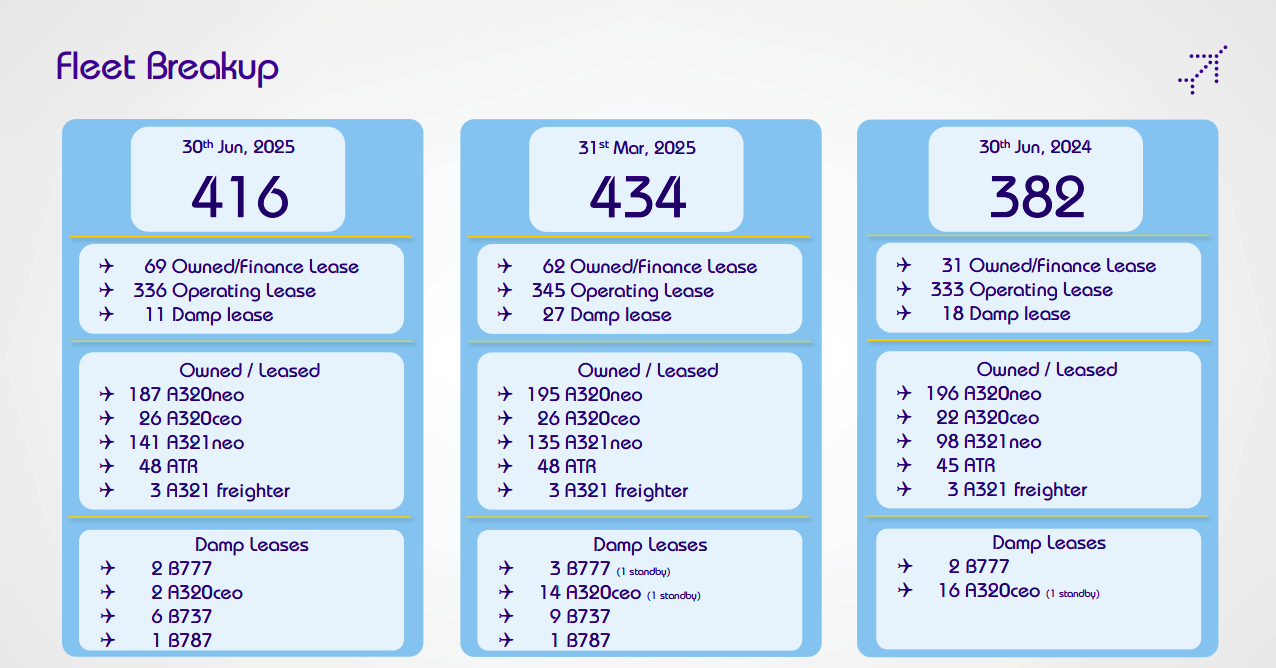

IndiGo’s fleet rose to 416 aircraft by June 30, 2025, up from 382 a year earlier, though slightly down from 434 in March 2025. The mix includes 187 A320neo, 141 A321neo, 26 A320ceo, 48 ATRs, and 3 A321 freighters, alongside 11 damp leases. The share of owned/finance leases increased to 69, while operating leases remained dominant at 336. Damp leases included widebody aircraft like B777s and B787s along with B737s and A320ceos.

Varun Beverages | Large Cap | FMCG

Varun Beverages, along with its subsidiaries, joint venture, and associates, manufactures, sells, bottles, and distributes Pepsi brand beverages in specified territories across several countries. The company operates under a franchise agreement with PepsiCo India and its affiliates, with sales of its products being seasonal.

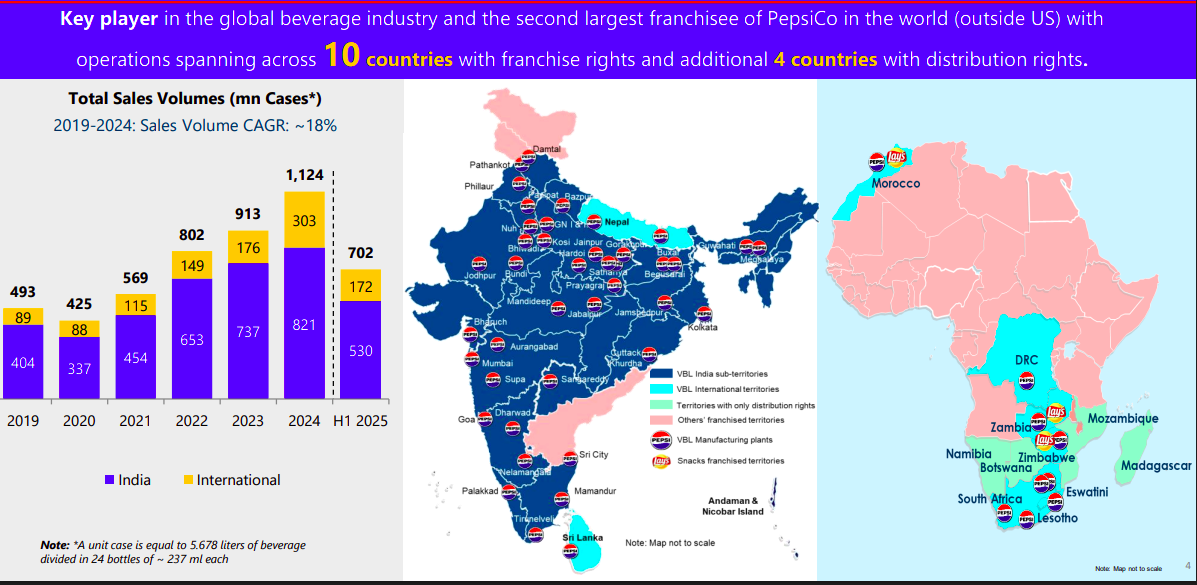

Varun Beverages, PepsiCo’s 2nd largest global franchisee, operates across 10 countries with rights in 4 more, offering a wide portfolio spanning Pepsi, Tropicana, Gatorade, Aquafina, and its own brands like Refreshh & Cream Bell. Sales volumes grew at an ~18% CAGR (2019–24), reaching 1.12 bn cases in 2024, with India driving bulk volumes and expanding presence across Africa and South Asia.

Globus Spirits Ltd | Mid Cap | FMCG

Globus Spirits Ltd was incorporated in 1993-94 (erstwhile name Globus Agronics Limited). The company caters to four important segments of the alcohol industry - Indian Made Indian Liquor (IMIL), Indian Made Foreign Liquor (IMFL), IMFL Bottling and Bulk Alcohol.

Globus Spirits forays into the beer market with CARIB Premium Strong Beer, brewed in UP via a JV with ANSA McAL, priced at ₹130 per can to bring Caribbean flavours to Indian consumers.

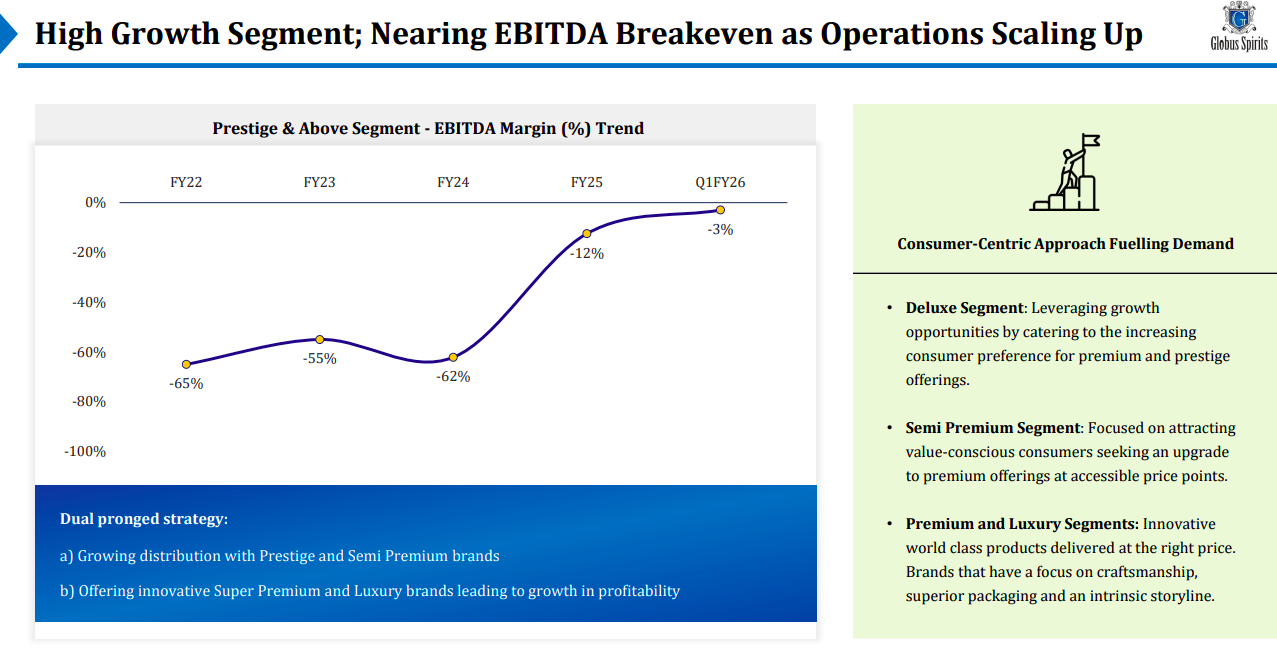

Globus Spirits’ prestige & above segment has improved margins from -65% in FY22 to -3% in Q1 FY26, nearing breakeven, backed by a dual strategy of expanding semi-premium/premium reach and launching innovative super-premium brands.

Piccadily Agro Industries Ltd | Small Cap | FMCG

Piccadily Agro Inds. Ltd. is in the business of manufacturing of sugar and it’s by-products.The product range of the company includes white crystal sugar, molasses and bagasse and liquor..The company also engagged in the business of Sugar Unit, Distillery Unit.

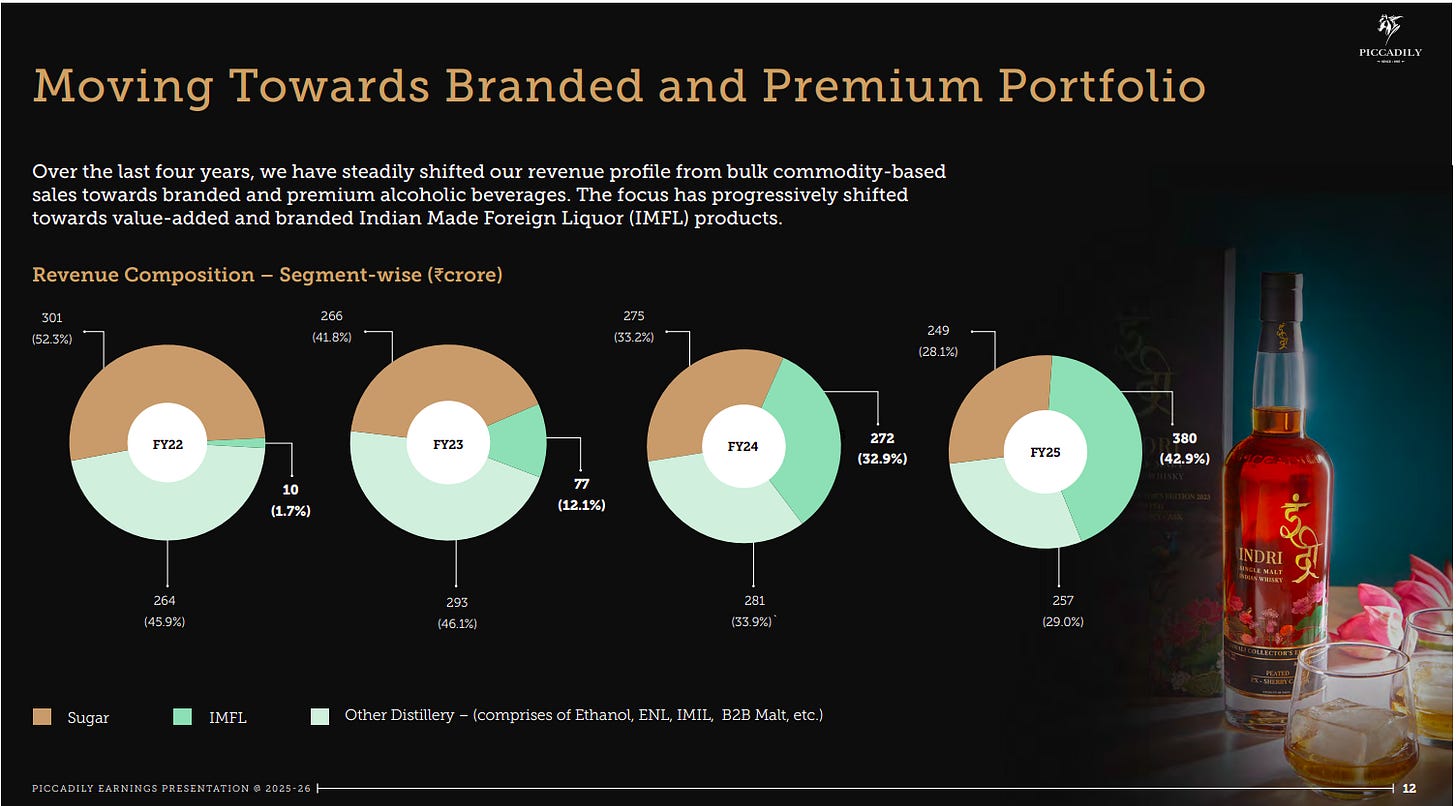

Revenue composition has steadily shifted towards premium beverages, with IMFL share rising to 42.9% in FY25, while sugar declined to 28.1% and distillery (ethanol, ENL, malt, etc.) formed 29%.

Piccadily’s company EBITDA margin improved to 21.4% in FY25, driven by distillery margins rising to 30.2%, while sugar margins stayed weak at -1.1%.

Godfrey Phillips India Ltd | Mid Cap | FMCG

Godfrey Phillips India Limited, a leading FMCG company in India, is known for iconic cigarette brands like Four Square and Red & White. It has an exclusive agreement with Philip Morris International for Marlboro. The company has diversified into chewing products, confectionery, and retail with brands like Pan Vilas and Funda Goli.

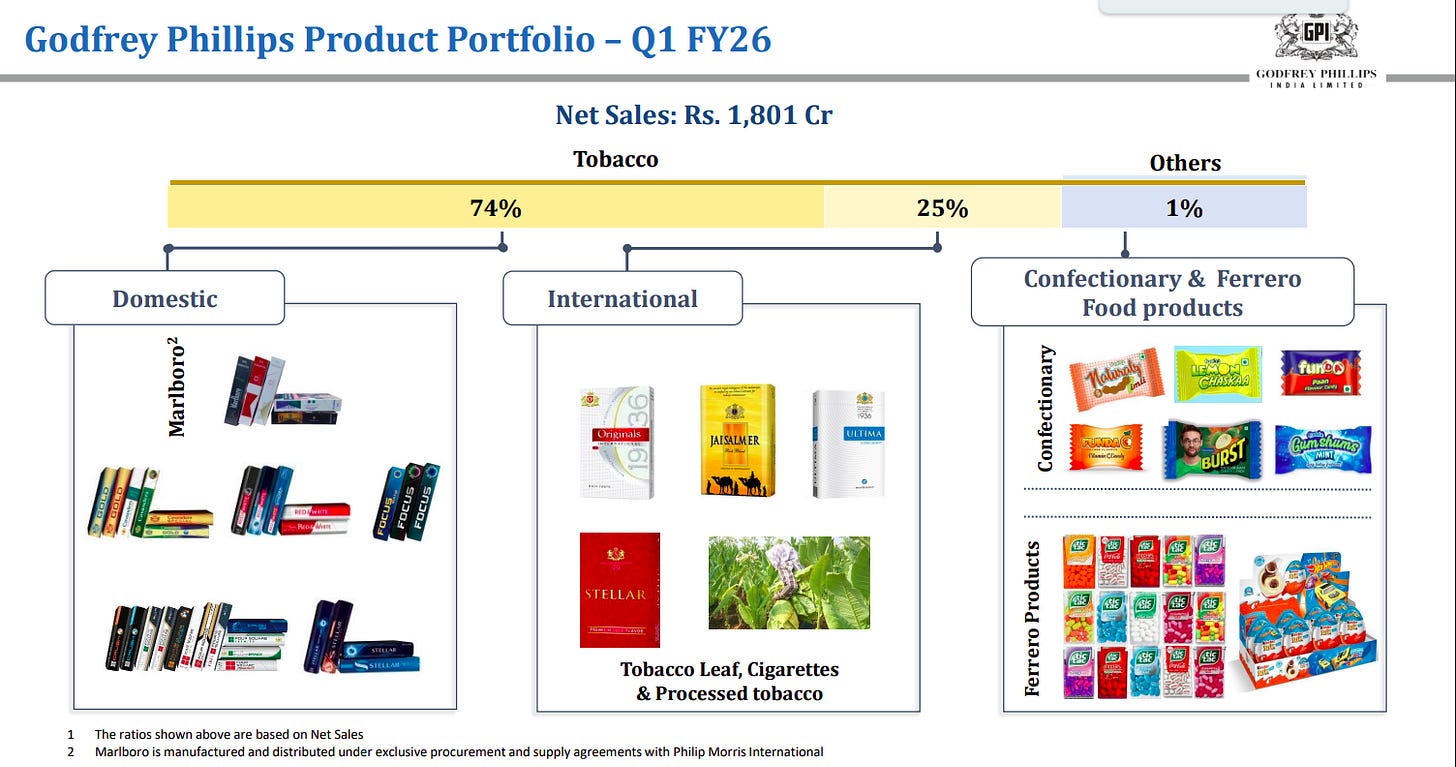

In Q1 FY26, GPI reported ₹1,801 Cr net sales, with tobacco contributing 99% (domestic Marlboro & own brands, plus international leaf & cigarettes), and confectionery & Ferrero products at 1%.

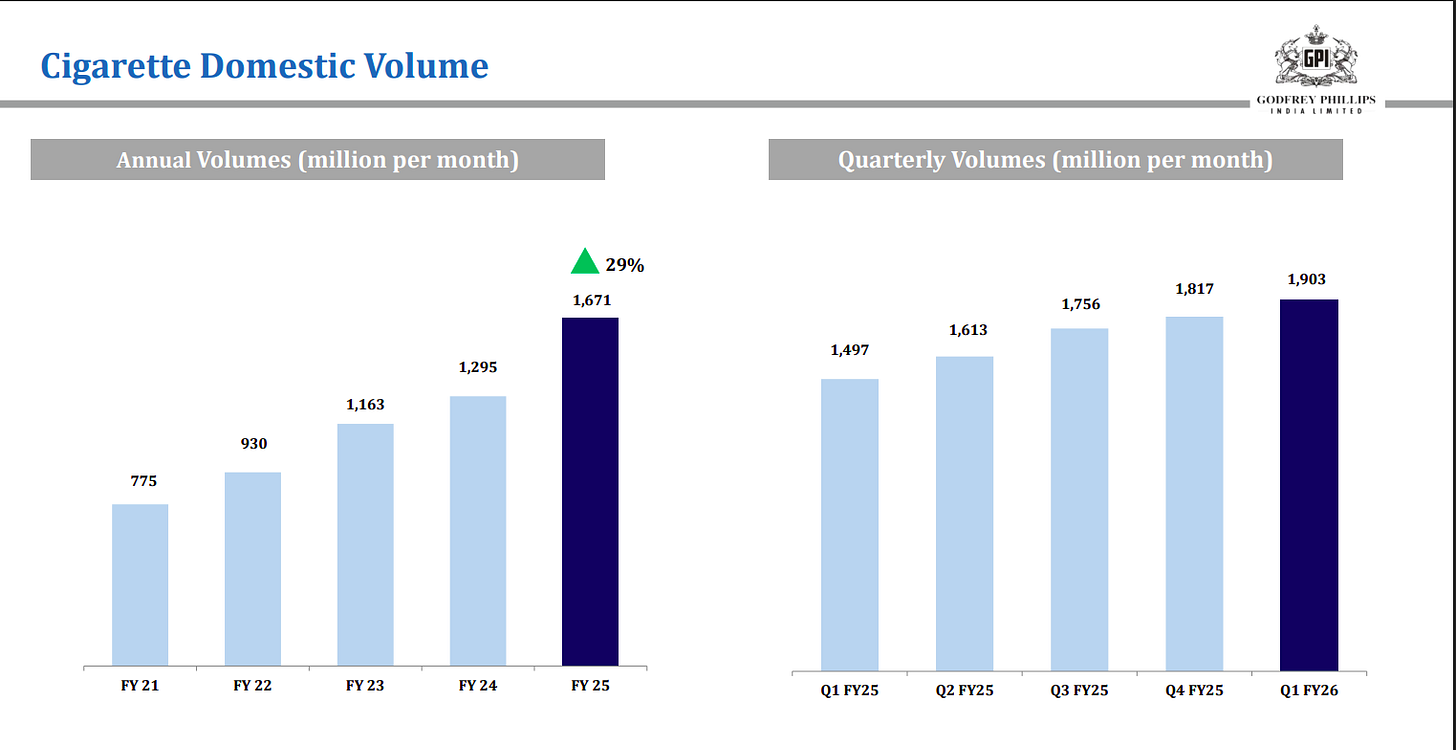

Godfrey Phillips’ cigarette volumes grew 29% YoY in FY25 to 1,671 mn sticks/month, with strong momentum continuing into Q1 FY26 at 1,903 mn.

Hindalco Industries Ltd | Large Cap | Metals

Hindalco Industries Limited is a part of the Aditya Birla Group and is a leading player in the aluminium and copper industries. The company produces a wide range of aluminium and copper products, including hydrate, alumina, copper rods, cathodes, sulfuric acid, and fertilizers.

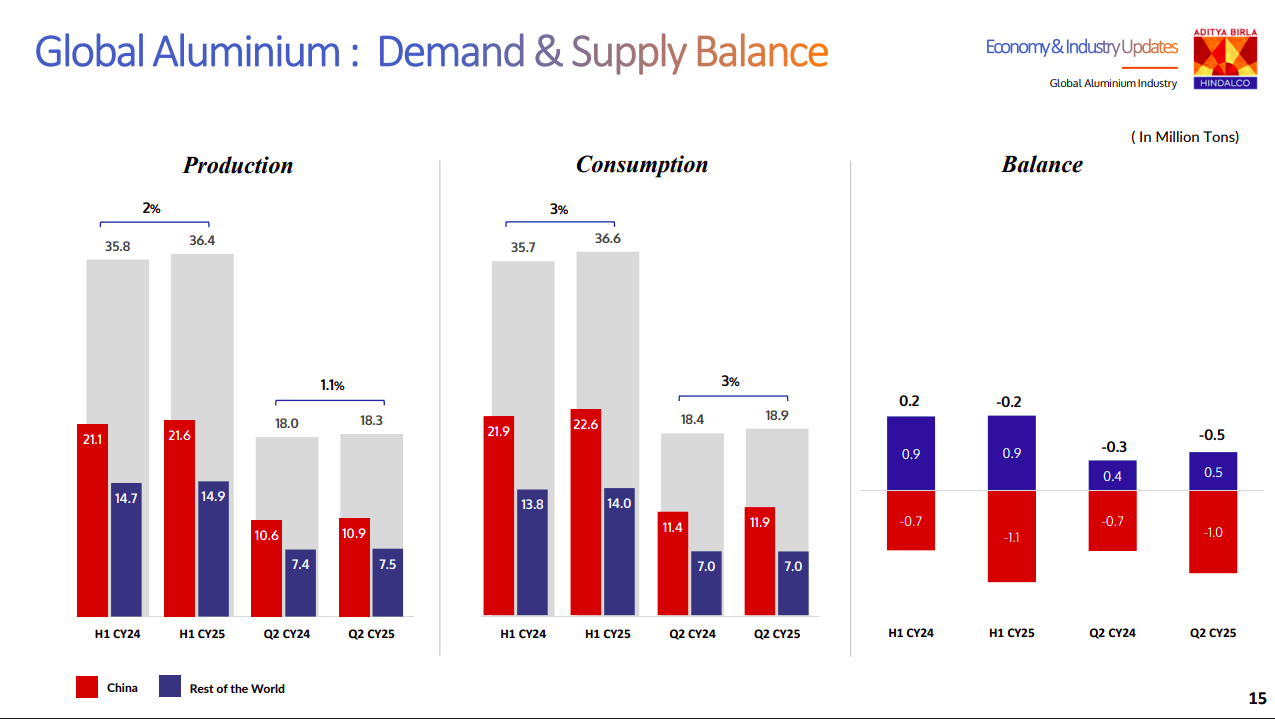

Global aluminium production rose 2% in H1 CY25, but consumption grew 3%, leading to a 0.2–0.5 MT deficit, mainly due to higher Chinese demand.

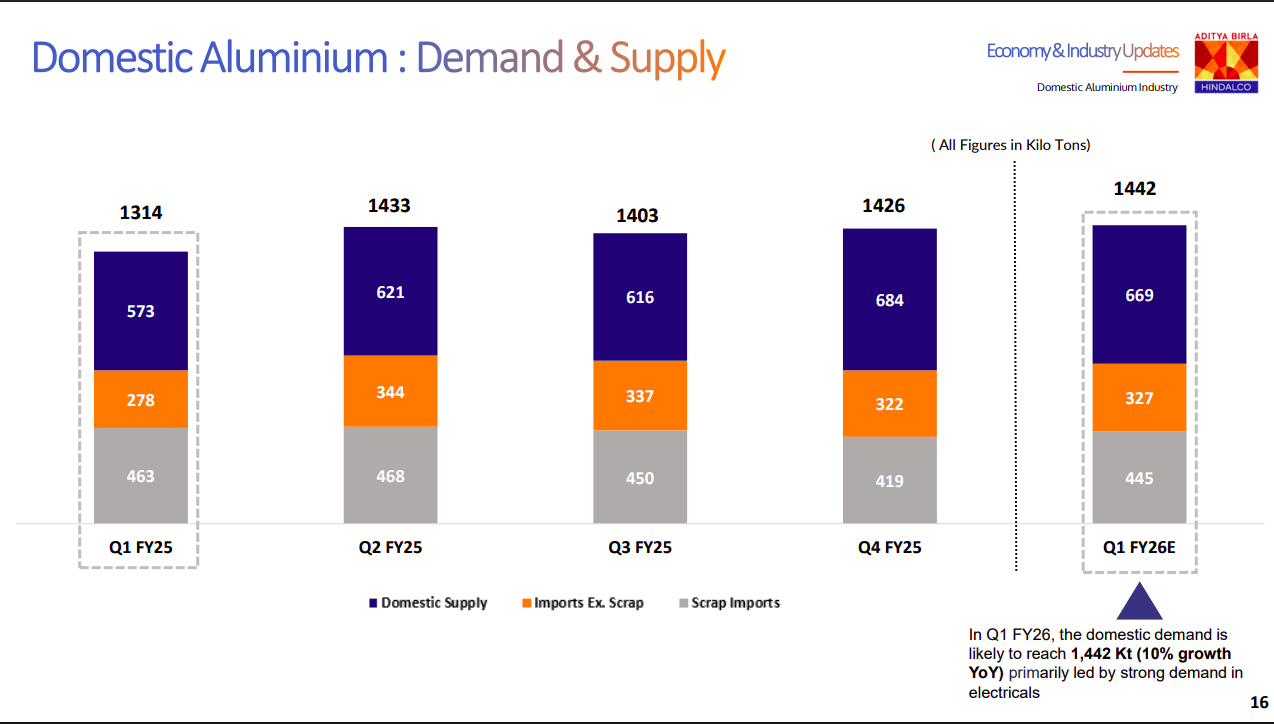

India’s domestic aluminium demand is expected to reach 1,442 KT in Q1 FY26 (10% YoY growth), driven by strong demand in electricals.

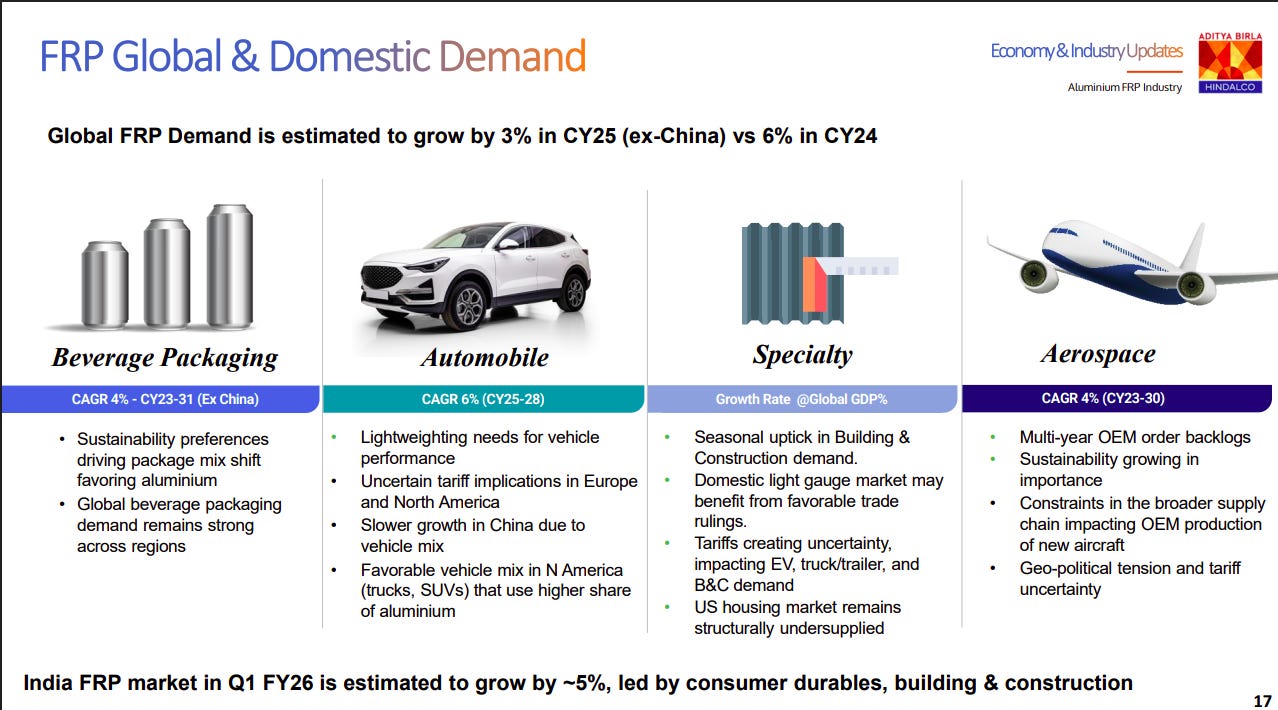

Global FRP demand is projected to grow 3% in CY25 (ex-China), led by beverage packaging (CAGR 4%), autos (6%), specialty, and aerospace (4%), while India’s FRP demand grew ~5% in Q1 FY26.

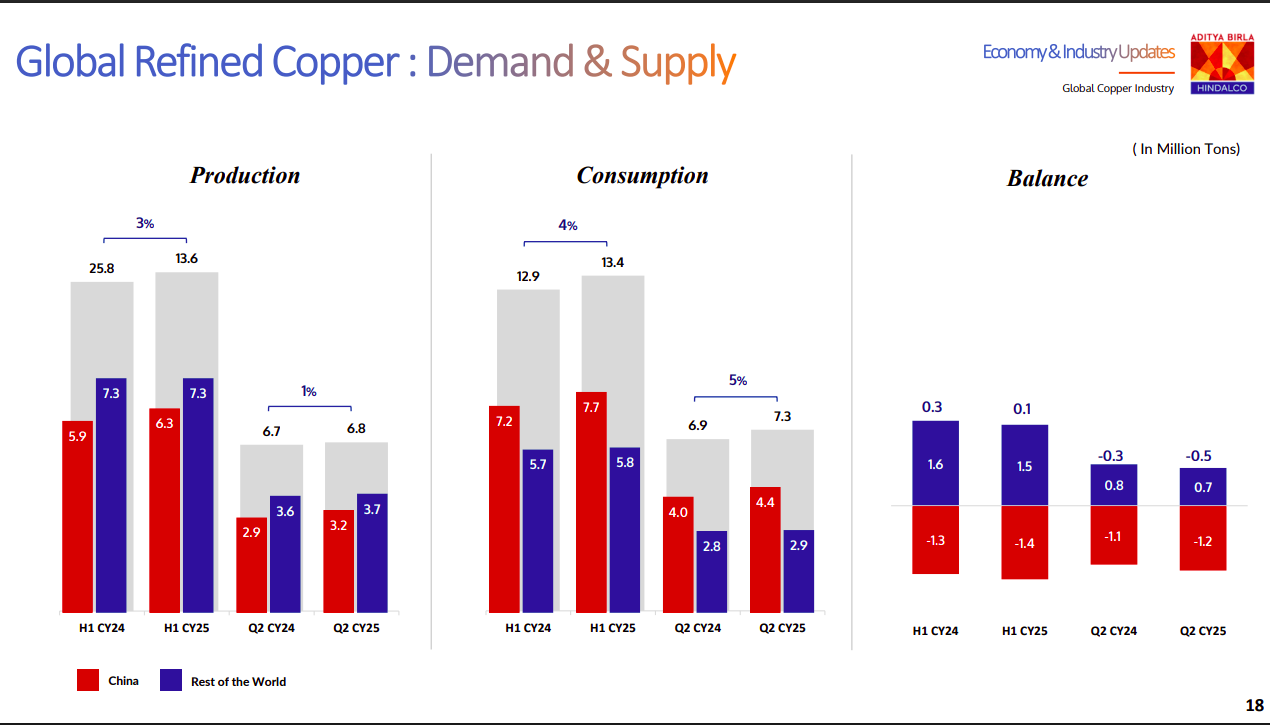

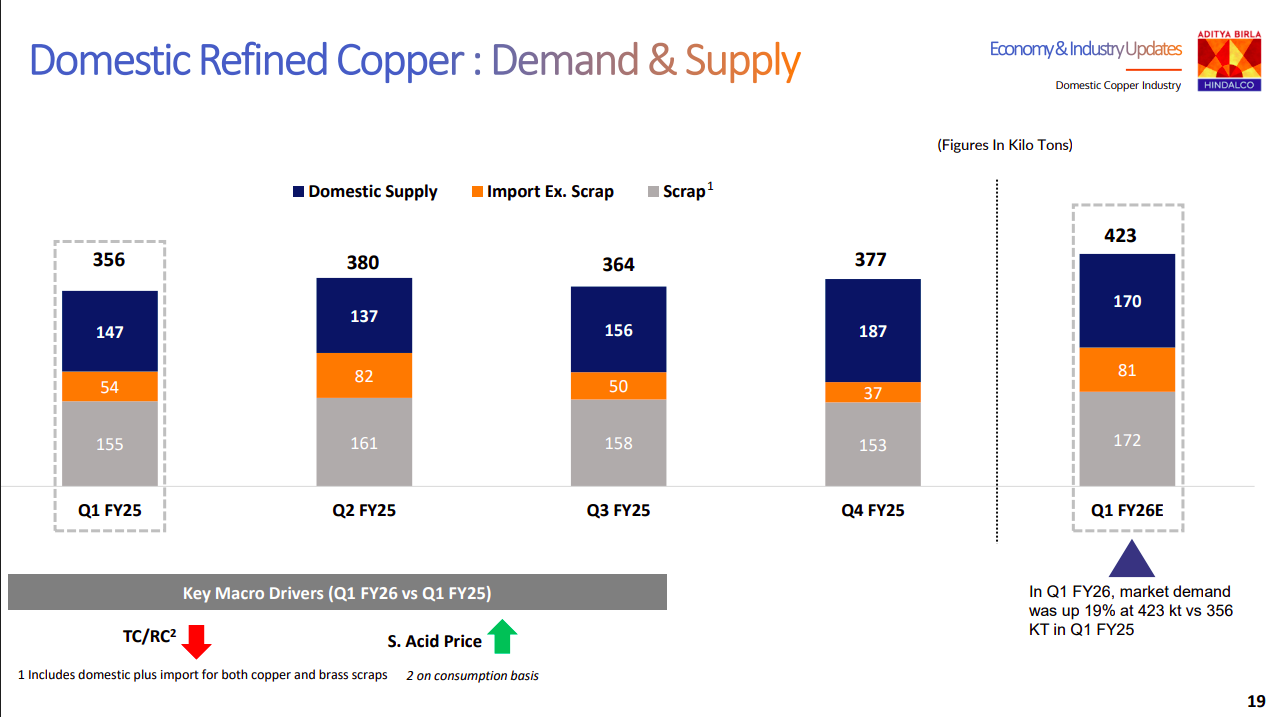

Global refined copper production grew 3% YoY in H1 CY25, but consumption rose faster at 4%, keeping the market nearly balanced with only 0.1 MT surplus.

India’s refined copper demand rose 19% YoY in Q1 FY26 to 423 KT (vs 356 KT last year), with higher domestic supply (170 KT) and imports (81 KT).

Samvardhana Motherson | Large Cap | Auto Ancillary

Samvardhana Motherson International Limited, formerly known as Motherson Sumi Systems Limited, is a global manufacturing specialist and the leading supplier to automotive OEMs. With a presence on five continents, the company serves customers in various industries like Aerospace, Logistics, Health & Medical, and Information Technology, offering support for evolving industrial trends worldwide.

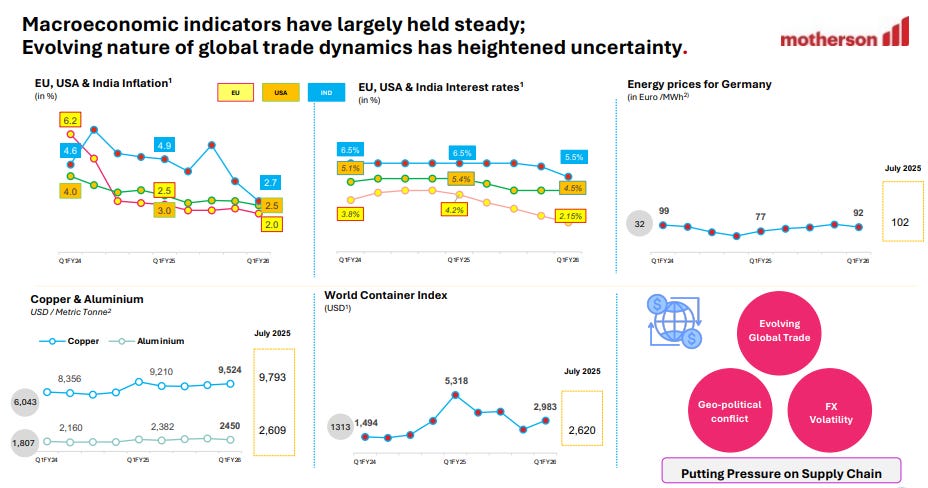

Global supply chains face renewed pressure as easing inflation and interest rates collide with rising energy and commodity prices.

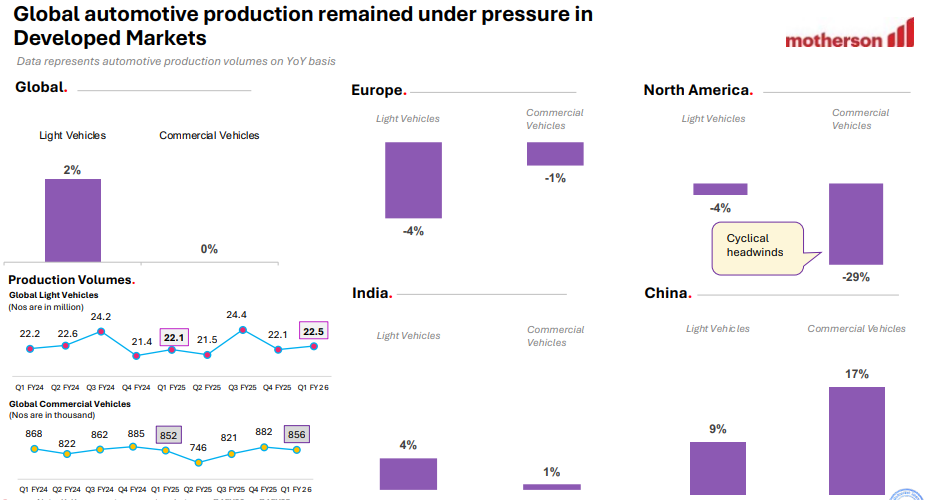

China is driving growth in vehicle production while North America and Europe remain weak.

Arman Financial Services Ltd | Small Cap | Financial Services

Arman Financial Services Limited (ASFL) provides affordable financing for personal mobility through two-wheeler and three-wheeler financing, aimed at improving the lives of the middle-class and emerging middle-class. Additionally, they offer small income generating loans to bottom-of-pyramid customers, helping uplift poor households by enhancing their incomes and livelihoods.

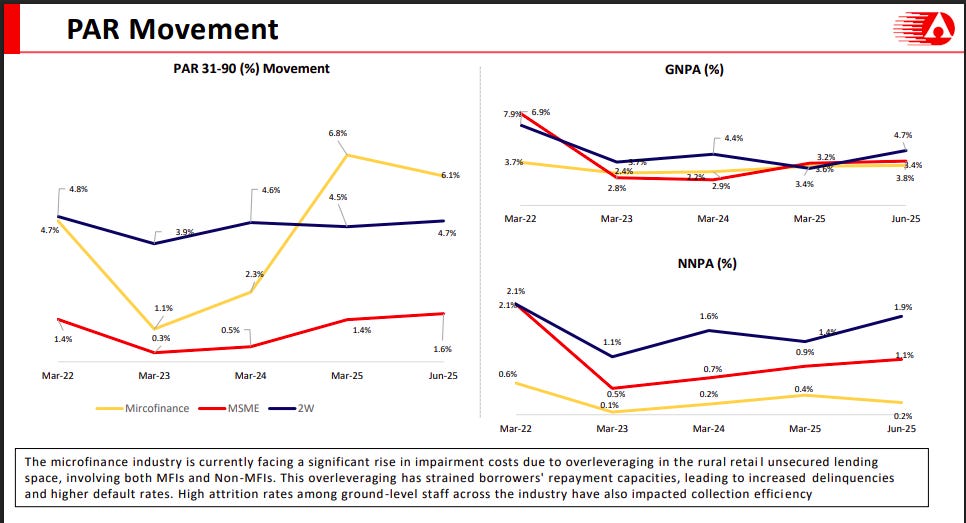

Arman’s asset quality shows stress in Microfinance PAR 31–90, rising to 6.1% in Jun-25 vs 0.3% in Mar-23, while MSME (1.6%) and 2W (4.7%) remain relatively stable. GNPA stands at 4.7%, NNPA at 1.9%, highlighting pressure from rural overleveraging and weaker repayment capacity.

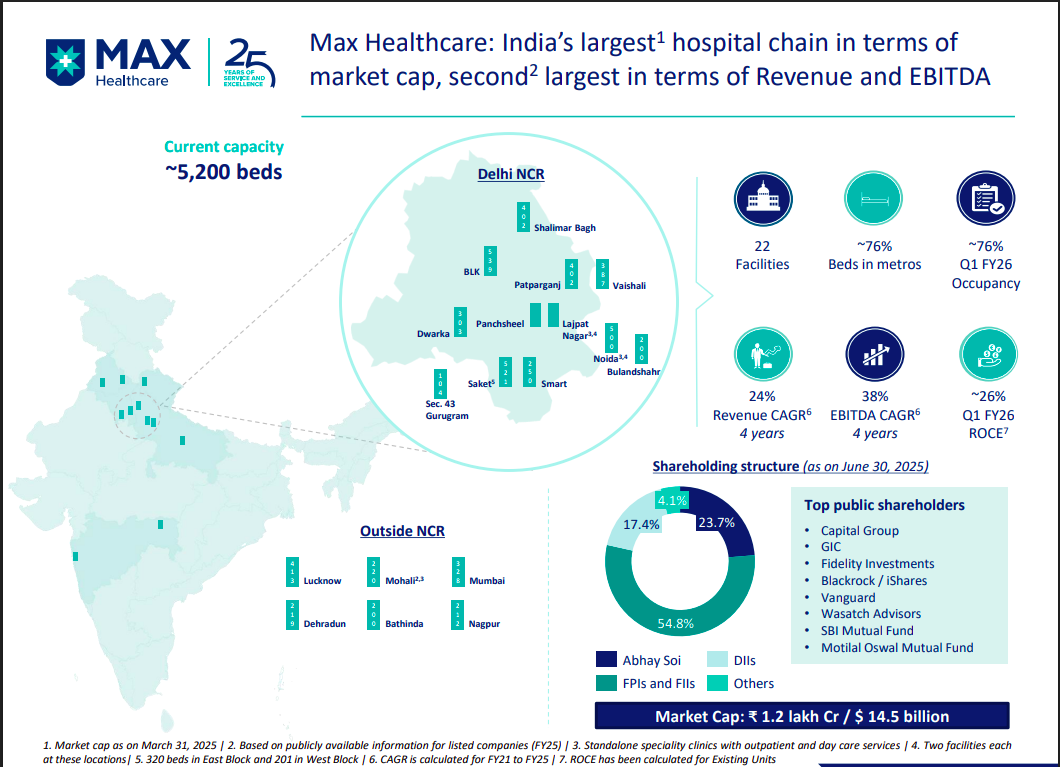

Max Healthcare Institute Ltd | Large Cap | Healthcare

Max Healthcare Institute operates multiple facilities in Delhi, the National Capital Region, Mohali, and Bathinda. It offers a wide range of healthcare services including cardiology, orthopedics, cancer treatment, pediatrics, aesthetics, and various surgical specialties.

Max Healthcare, India’s largest hospital chain by market cap and second largest by revenue & EBITDA, operates 22 facilities with ~5,200 beds (76% in metros) and reported 76% occupancy in Q1 FY26. Over the last 4 years, it has delivered 24% revenue CAGR, 38% EBITDA CAGR, and ~26% ROCE, with strong shareholder backing from global funds like Capital Group, GIC, Fidelity, and BlackRock.

Saregama India Ltd | Small Cap | Media & Entertainment

Saregama India Limited, a part of RP Sanjiv Goenka Group, is India's oldest music label and a leading film studio. It holds the largest collection of Indian music copyrights spanning multiple languages. With over 4000 hours of TV content and innovative initiatives like Saregama Carvaan and Yoodlee Films, the company continues to innovate and evolve in the music and entertainment industry.

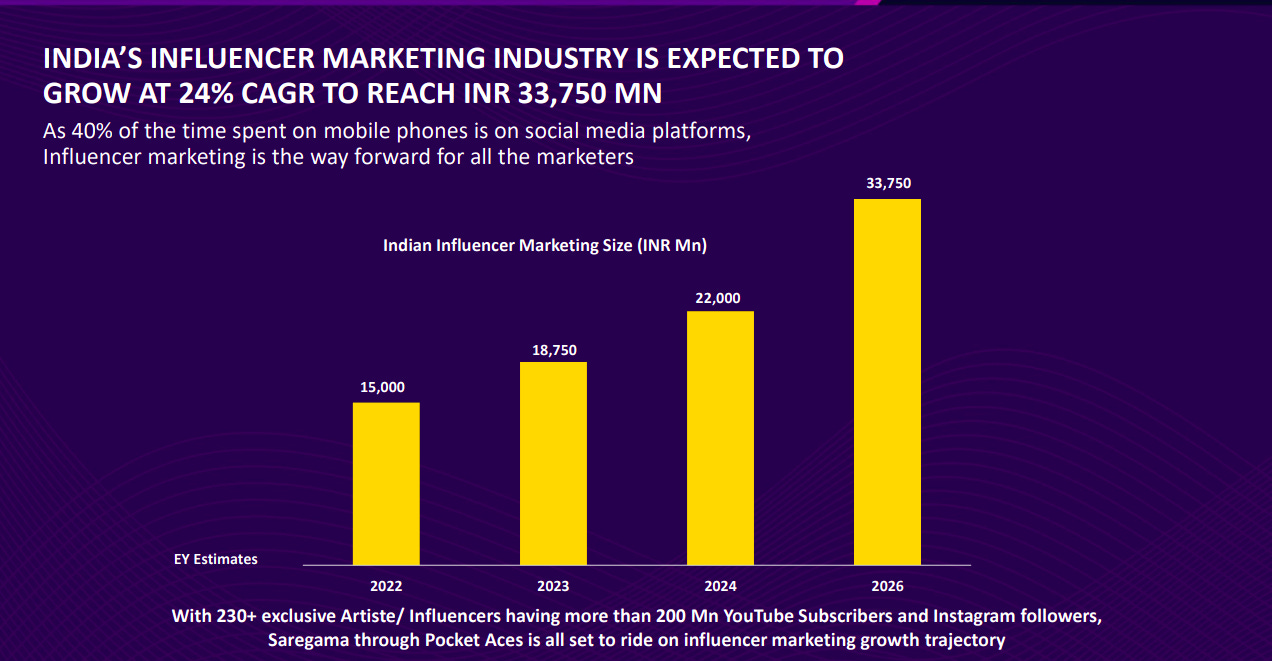

India’s influencer marketing industry is projected to grow at 24% CAGR to ₹33,750 Mn by 2026, with Saregama leveraging Pocket Aces’ 230+ influencers and 200Mn+ followers.

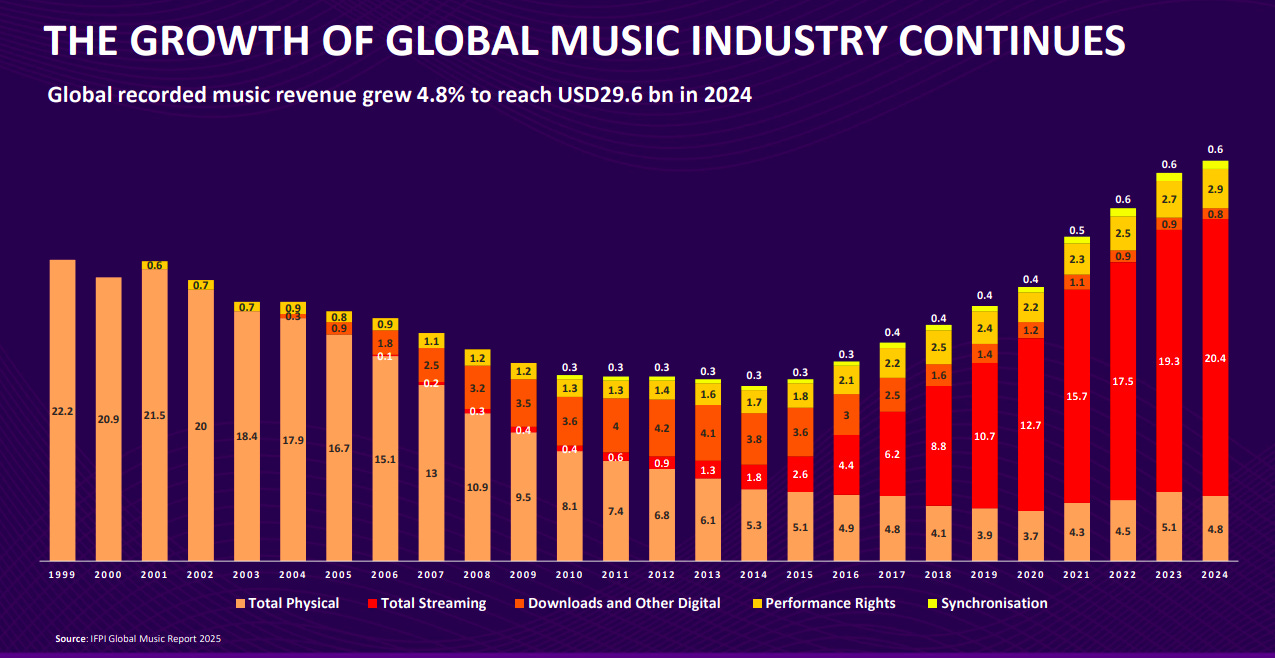

Global recorded music revenue reached $29.6B in 2024 (+4.8%), with streaming now the dominant driver at $20.4B, outpacing physical and digital downloads.

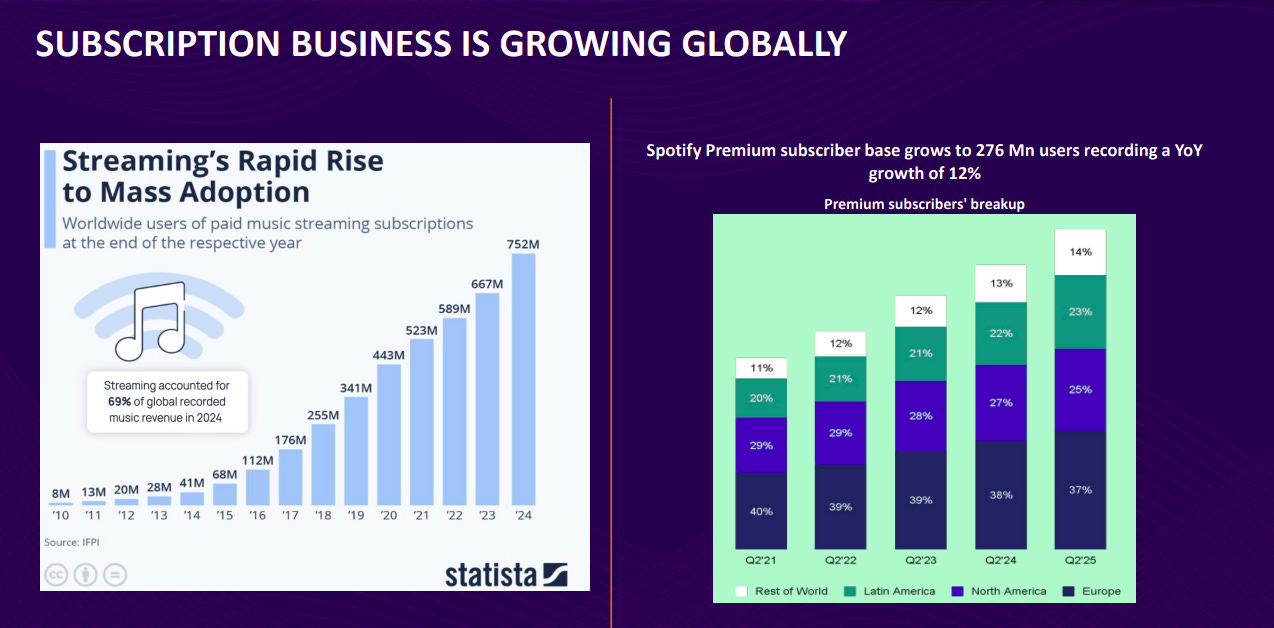

Global paid music streaming subscriptions surged to 752M in 2024, now driving 69% of industry revenue; Spotify premium users hit 276M (+12% YoY) with growth across all regions.

Grasim Industries Ltd | Large Cap | Diversified

Grasim Industries is a major global and Indian producer of Cellulosic Staple Fibre and Cellulosic Fashion Yarn, focusing on innovation and sustainability. They have expanded the market with Birla Modal and Birla Excel fibers in India and are known for the brand 'LIVA' and 'Raysil', providing luxurious and eco-friendly alternatives to synthetic fibers.

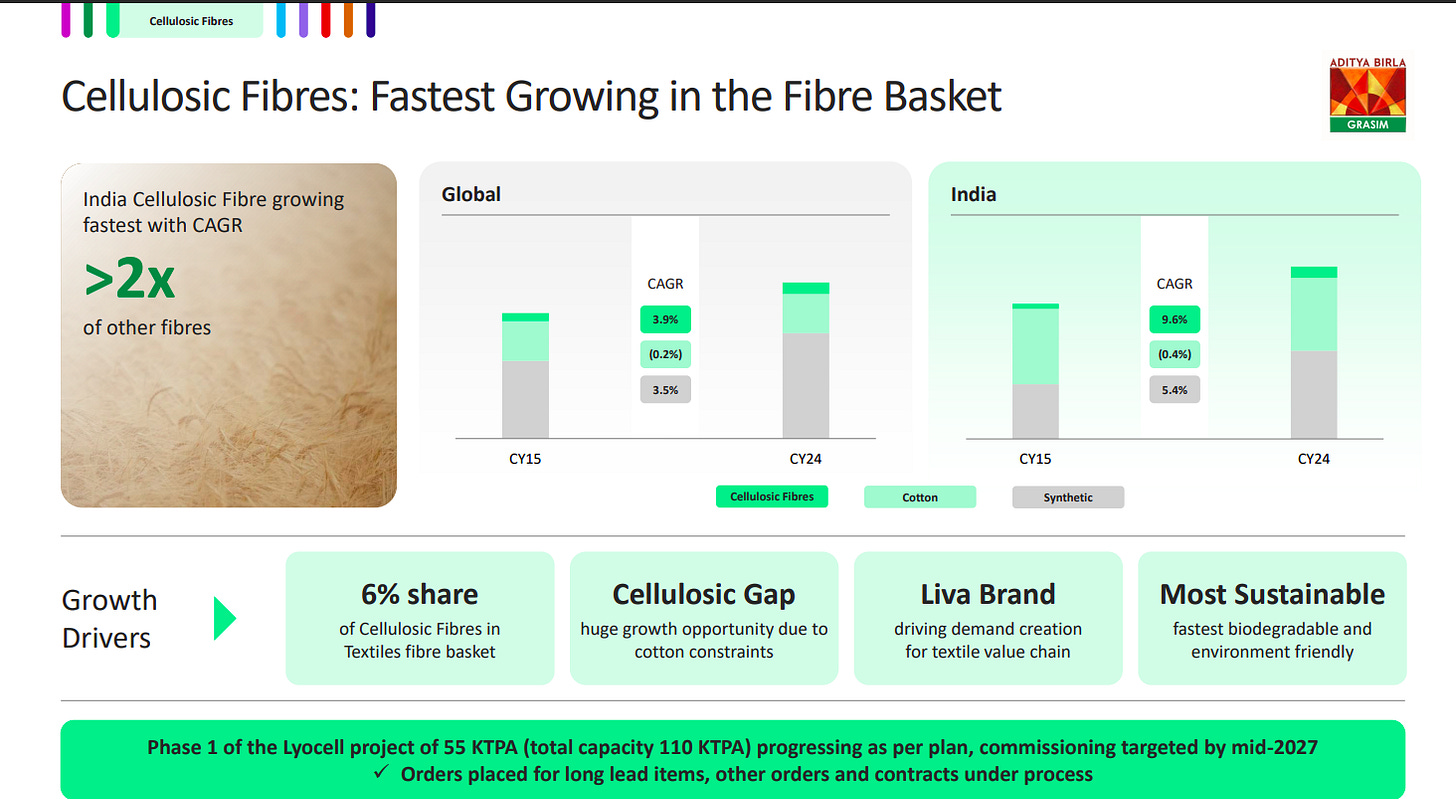

India’s cellulosic fibre demand is growing at >2x other fibres, with a 9.6% CAGR (CY15–24), driven by cotton supply constraints, Liva brand-led demand, and sustainability benefits.

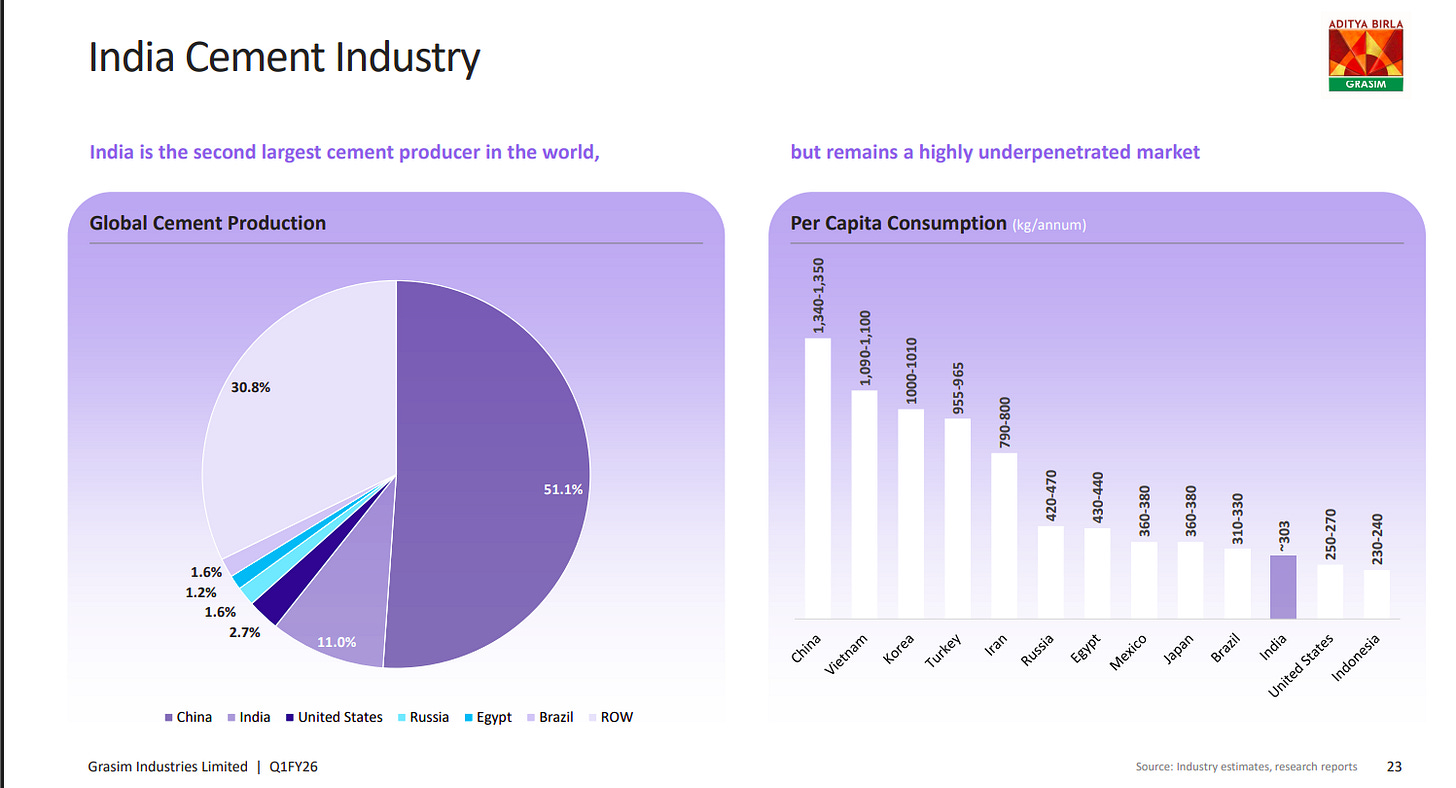

India is the 2nd largest cement producer globally (11% share) but remains underpenetrated, with per capita consumption at ~303 kg, far below China (>1,300 kg) and global peers.

ITC Hotels Ltd | Mid Cap | Tourism & Hospitality

ITC Hotels is a company that owns, operates, manages, and franchises hotels and resorts. They are dedicated to providing guests with authentic indigenous experiences that are environmentally and socially sustainable.

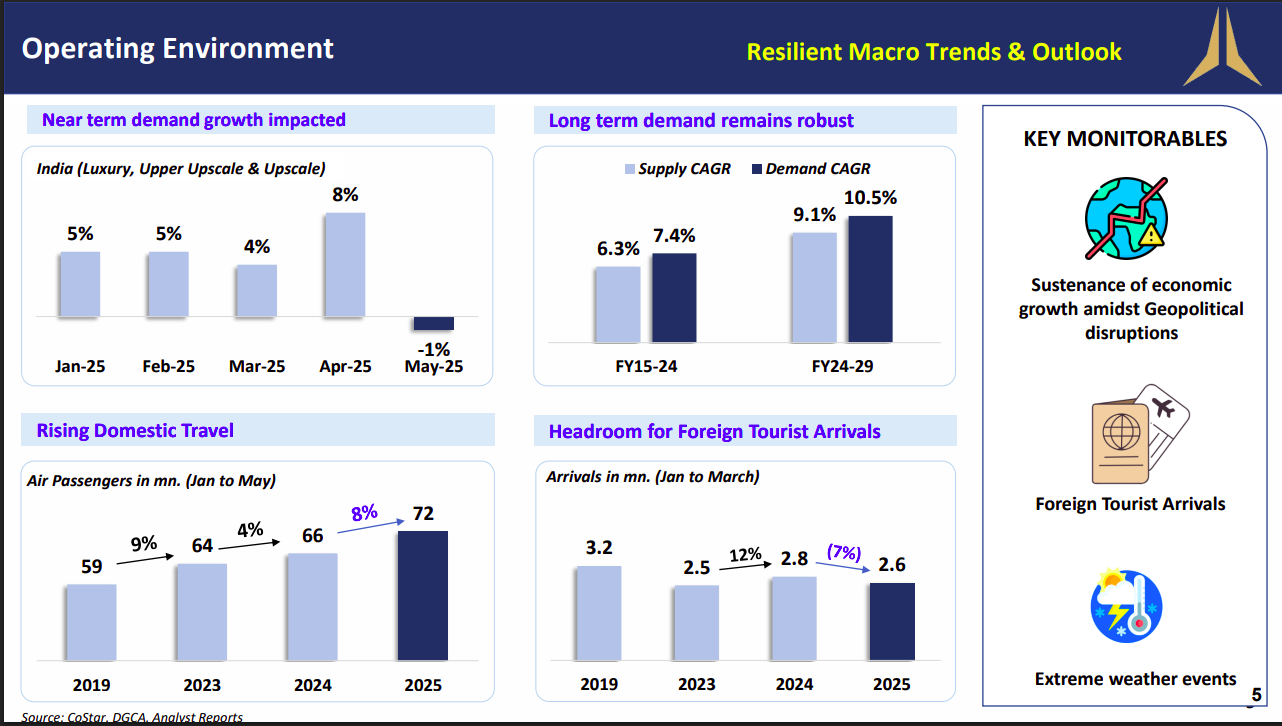

Hospitality demand softens near-term but long-term growth remains strong; domestic travel rising while foreign arrivals lag. Key risks: geopolitics & weather.

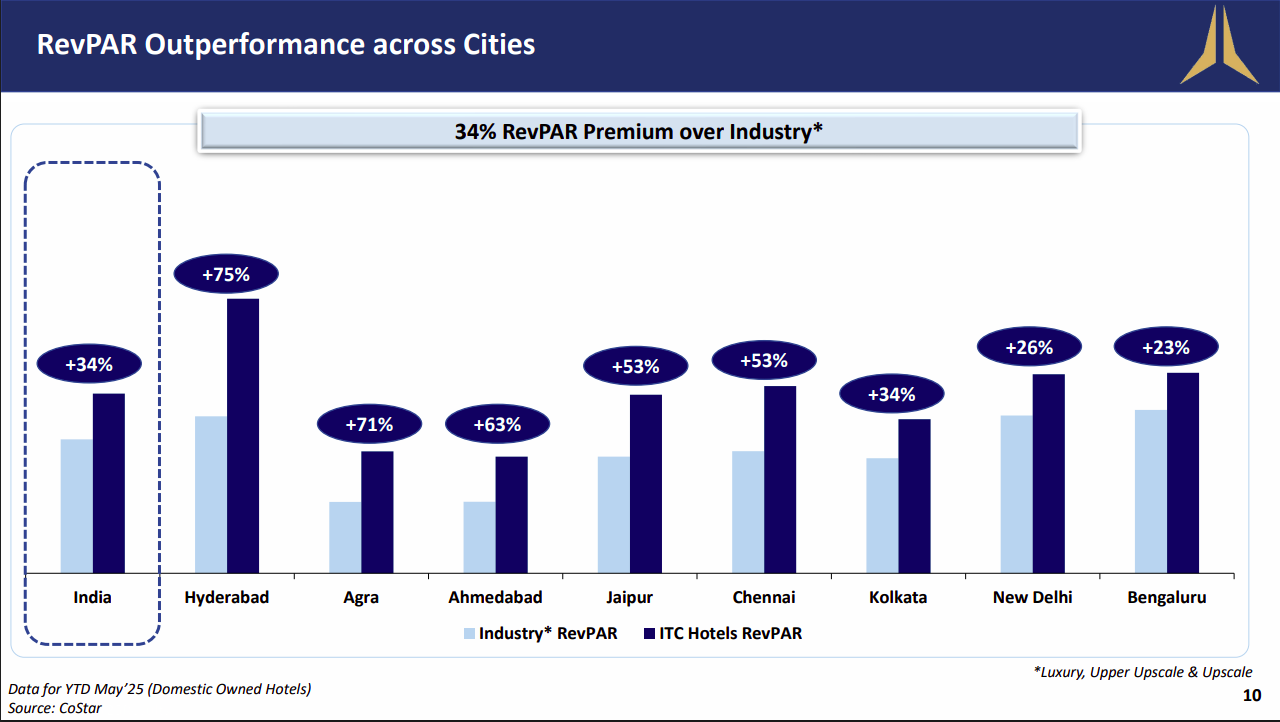

ITC Hotels outpaces peers with 34% RevPAR premium over industry; Hyderabad, Agra & Ahmedabad lead the charge.

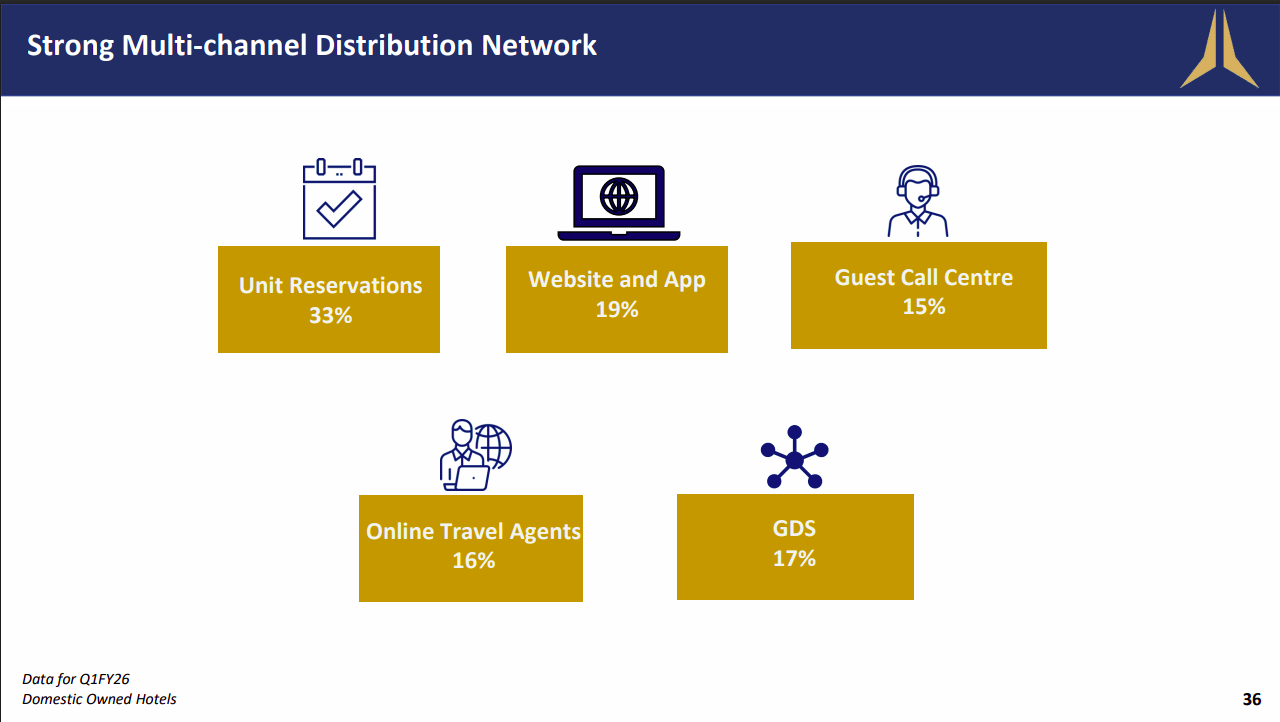

Multi-channel bookings power ITC Hotels — 33% from unit reservations, 19% via website/app, rest split across OTAs, GDS & call centres.

L&T Technology Serv | Mid Cap | Software Services

L&T Technology Services Limited is a global company specializing in Engineering Research and Development services for manufacturing, technology, and process engineering firms. With expertise in areas like engineering design, product development, smart manufacturing, and digitalization, it impacts daily human life.

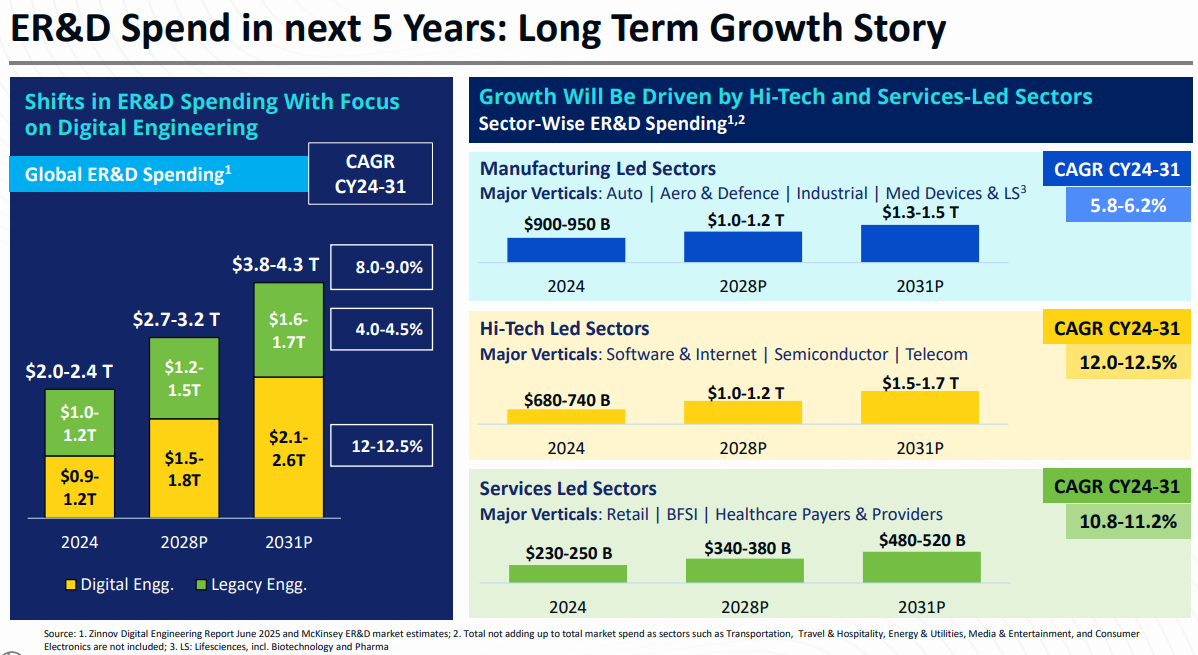

Spending on engineering R&D is shifting toward digital, with hi-tech and services sectors set to drive the fastest growth.

Titan Company Ltd | Large Cap | Retail

Titan Company, India's leading lifestyle company, offers watches, jewelry, eyewear, wearables, Indian dress wear, fragrances, and fashion accessories. With a focus on superior customer experience, Titan has established leading positions in the jewelry, watches, and eyewear categories, driven by trusted brands.

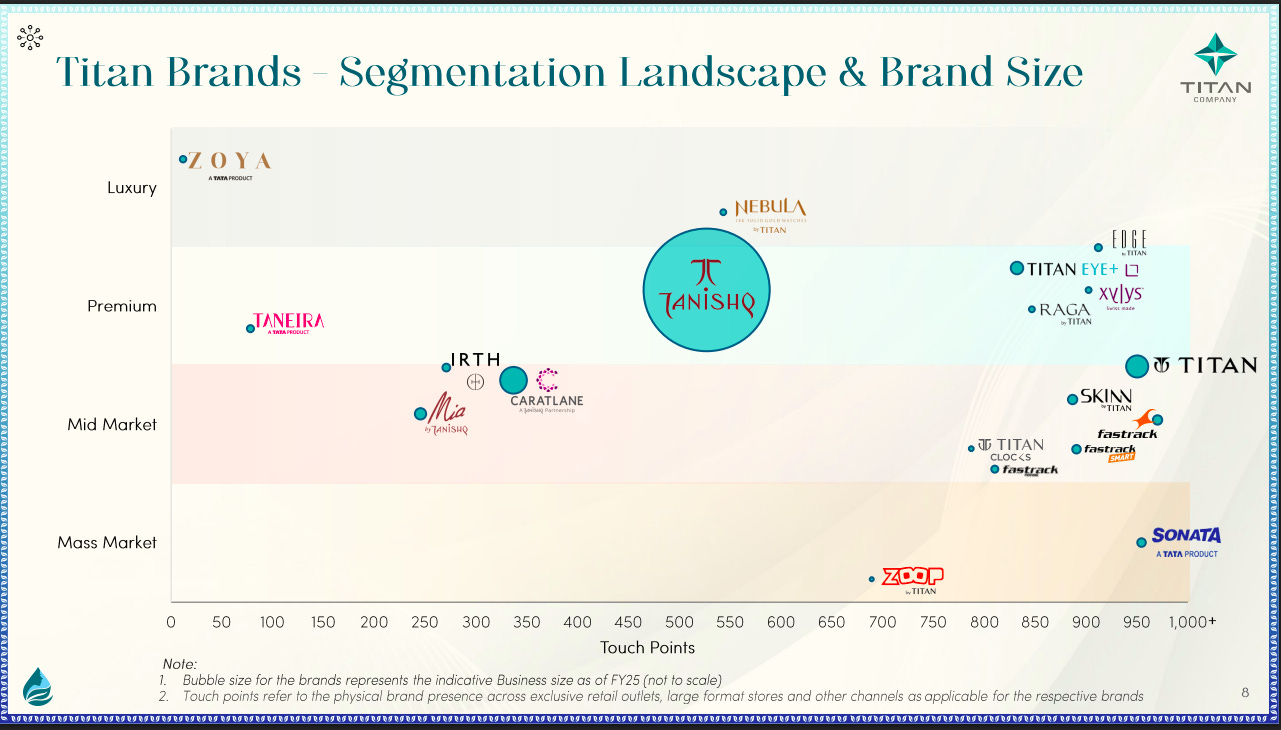

Titan’s brand portfolio spans across Luxury (Zoya), Premium (Tanishq, Nebula, Taneira, CaratLane, Titan Eye+, Raga, Xylys, Edge), Mid-Market (Mia, IRTH), and Mass-Market (Titan, Fastrack, Skinn, Sonata, Zoop), with Tanishq as the flagship brand and Sonata leading in reach with 1,000+ touchpoints.

Kalyan Jewellers India Ltd | Mid Cap | Retail

Kalyan Jewellers India Limited, one of the largest jewellery companies in India, started in 1993 and has since expanded across the country. They offer a wide range of jewellery products catering to special occasions like weddings, their highest-selling category, as well as daily wear.

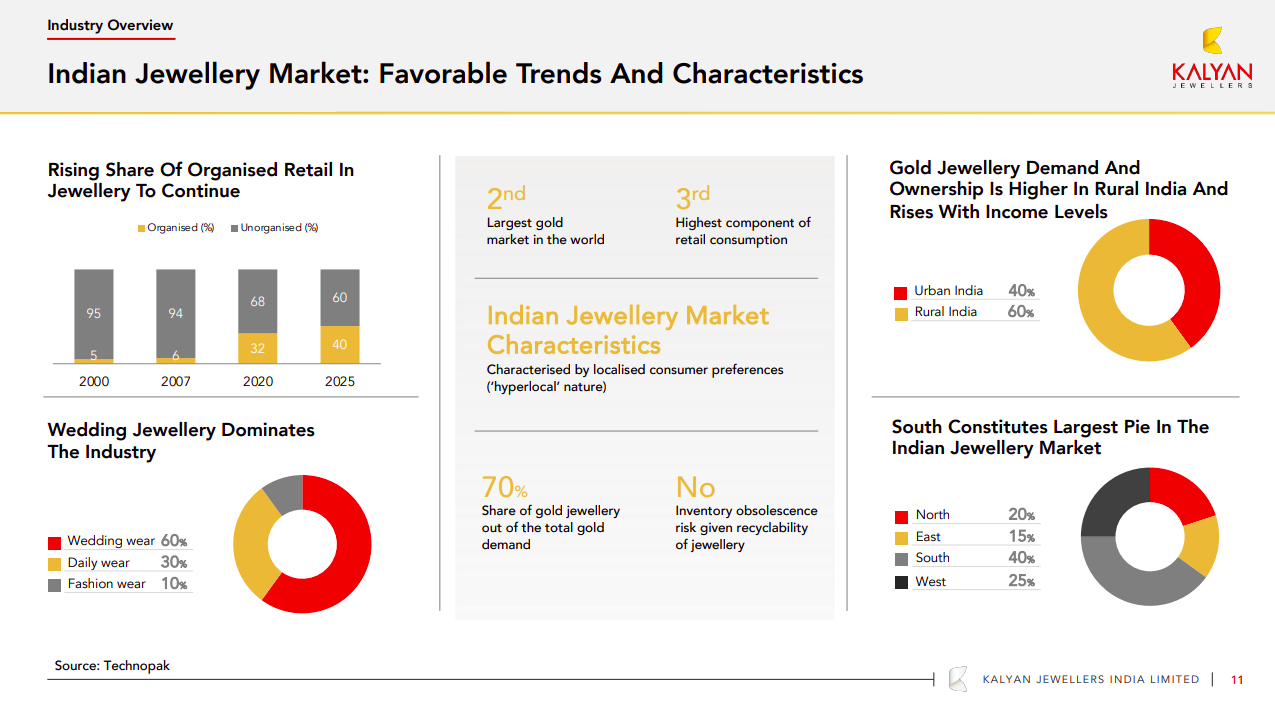

The Indian jewellery market is the 2nd largest gold market globally and ranks 3rd in retail consumption. Organised retail is steadily rising, projected to reach 40% by 2025, while wedding jewellery remains dominant at 60% of demand. Gold demand is stronger in rural India (60%) than urban (40%), and the South leads regionally with 40% share. With gold forming 70% of overall jewellery demand and being recyclable, the industry faces no risk of inventory obsolescence.

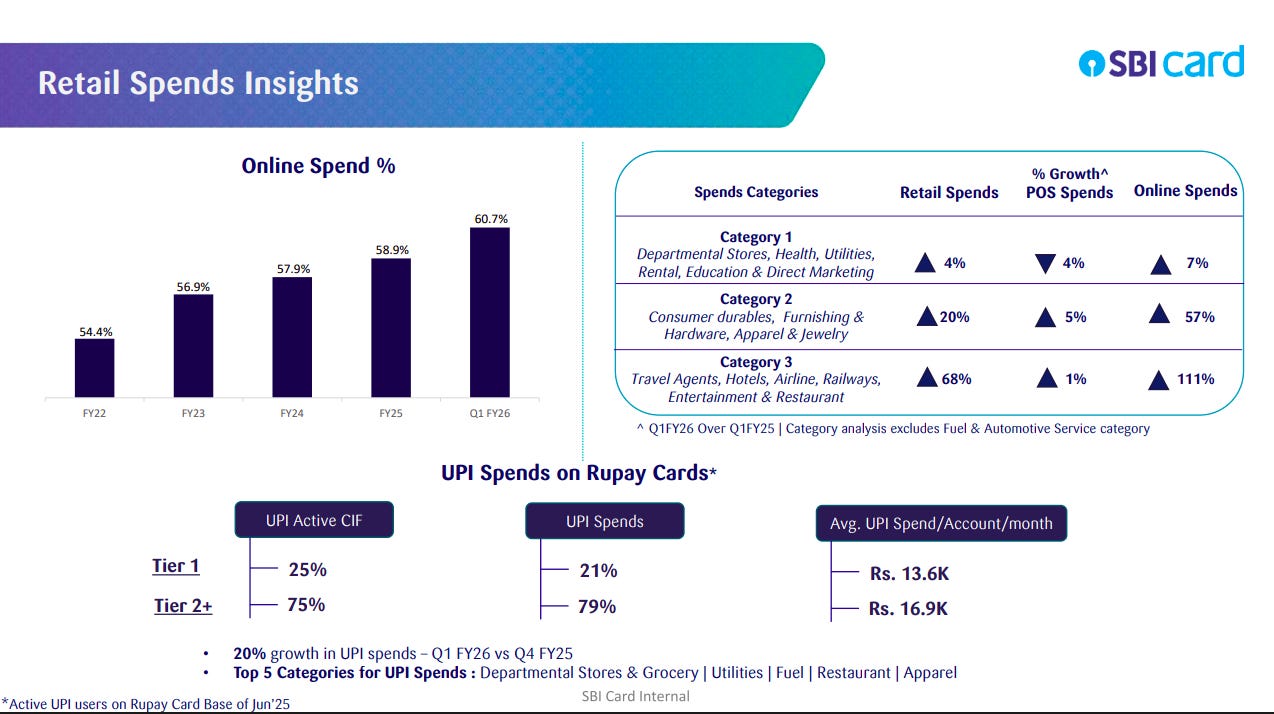

SBI Cards & Payment Services Ltd | Mid Cap | Financial Services

SBI Cards and Payment Services Limited, established in 1998 by State Bank of India and GE Capital, is based in Gurgaon, Haryana. It specializes in issuing credit cards to Indian consumers, offering a variety of payment products like premium, classic, travel, shopping, exclusive, and corporate cards. The company also serves as a corporate insurance agent for selling insurance policies to credit card holders.

SBI Card’s online spend share reached 60.7% in Q1 FY26 (up from 58.9% in FY25), with fastest growth in travel/entertainment (+111% online) and consumer durables (+57% online). UPI spends on RuPay cards grew 20% QoQ, led by Tier-2+ users (75% share), with average monthly spends at ₹13.6K–₹16.9K per account.

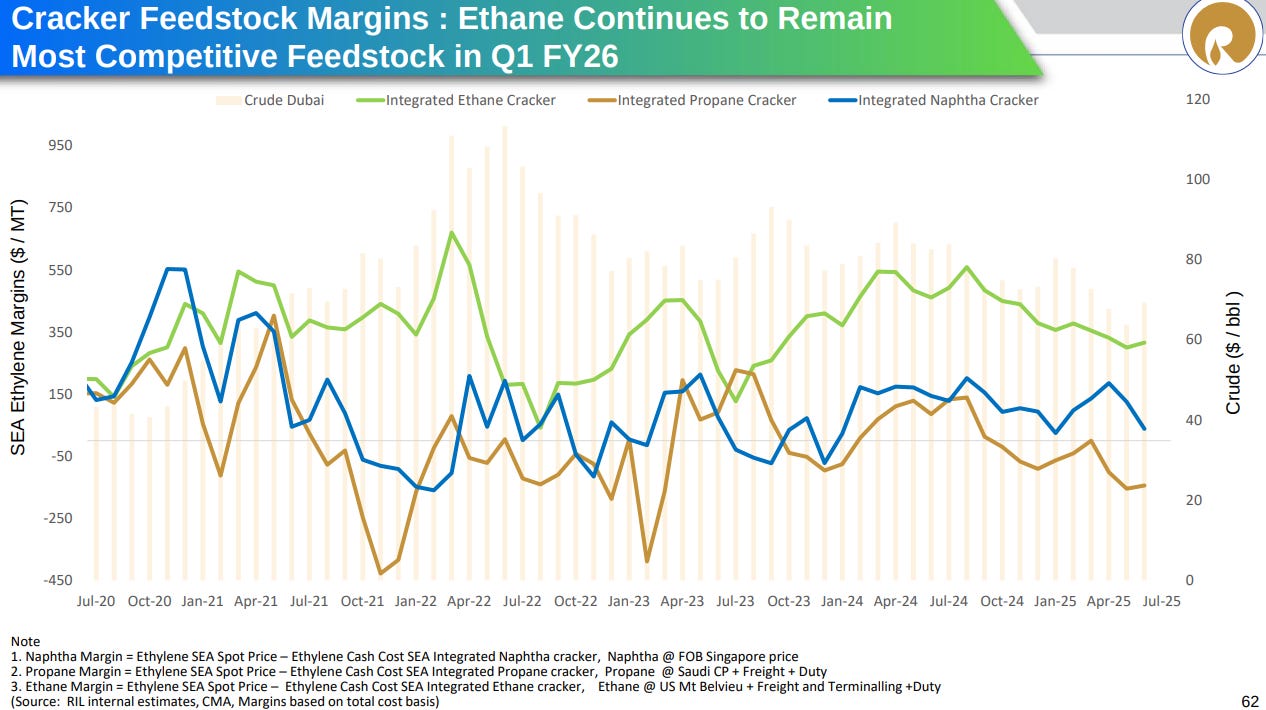

Reliance Industries Ltd.| Large Cap | Energy

Reliance Industries is India's largest private sector company with diverse operations in hydrocarbons, refining, petrochemicals, renewables, retail, and digital services. It leads in managing a fully integrated Oil-to-Chemicals portfolio and emphasizes inclusive growth by partnering with various stakeholders.

Ethane is holding its edge as the most profitable feedstock for petrochemical crackers.

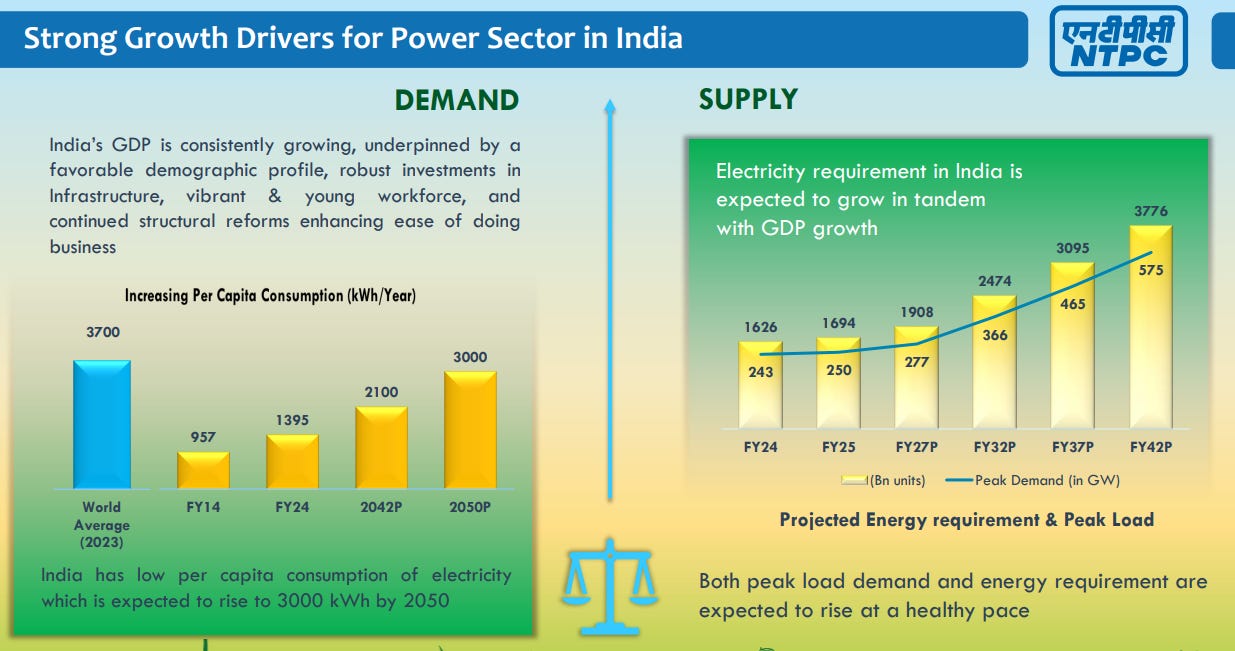

NTPC | Large Cap | Energy

NTPC, India's largest integrated power company, focuses on delivering reliable, affordable, and sustainable electricity to the nation through thermal, hydro, solar, and wind power plants. Committed to best practices and clean energy, NTPC also explores new ventures like e-mobility, battery storage, waste-to-energy, green hydrogen solutions, and power distribution.

India’s power demand is set to more than double by 2050 as per capita electricity use climbs toward global averages.

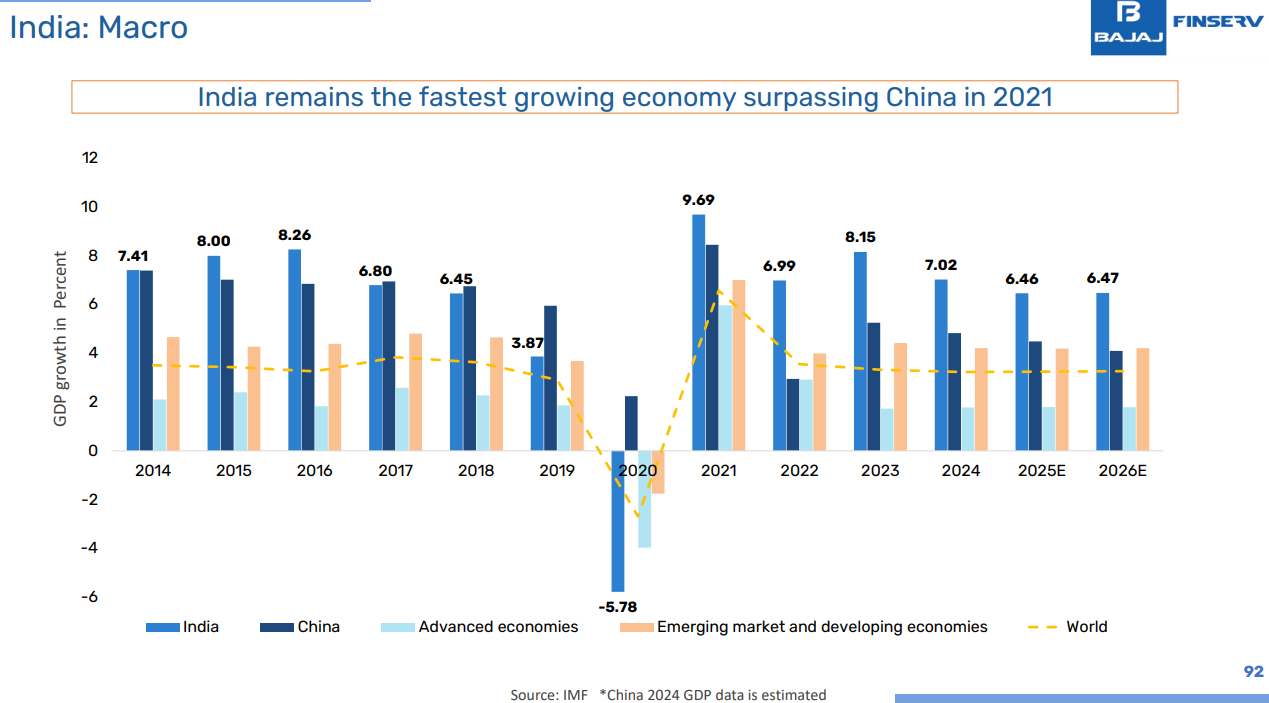

Bajaj Finserv | Large Cap | Financial Services

Bajaj Finserv is a prominent financial services company in India offering a wide range of financial solutions including savings products, loans, insurance, and investments. With a vision for pan-India presence, it aims to provide diverse financial services to meet the needs of its customers and enhance their financial resilience.

India has held on to its position as the fastest-growing major economy, outpacing China and the global average post 2021.

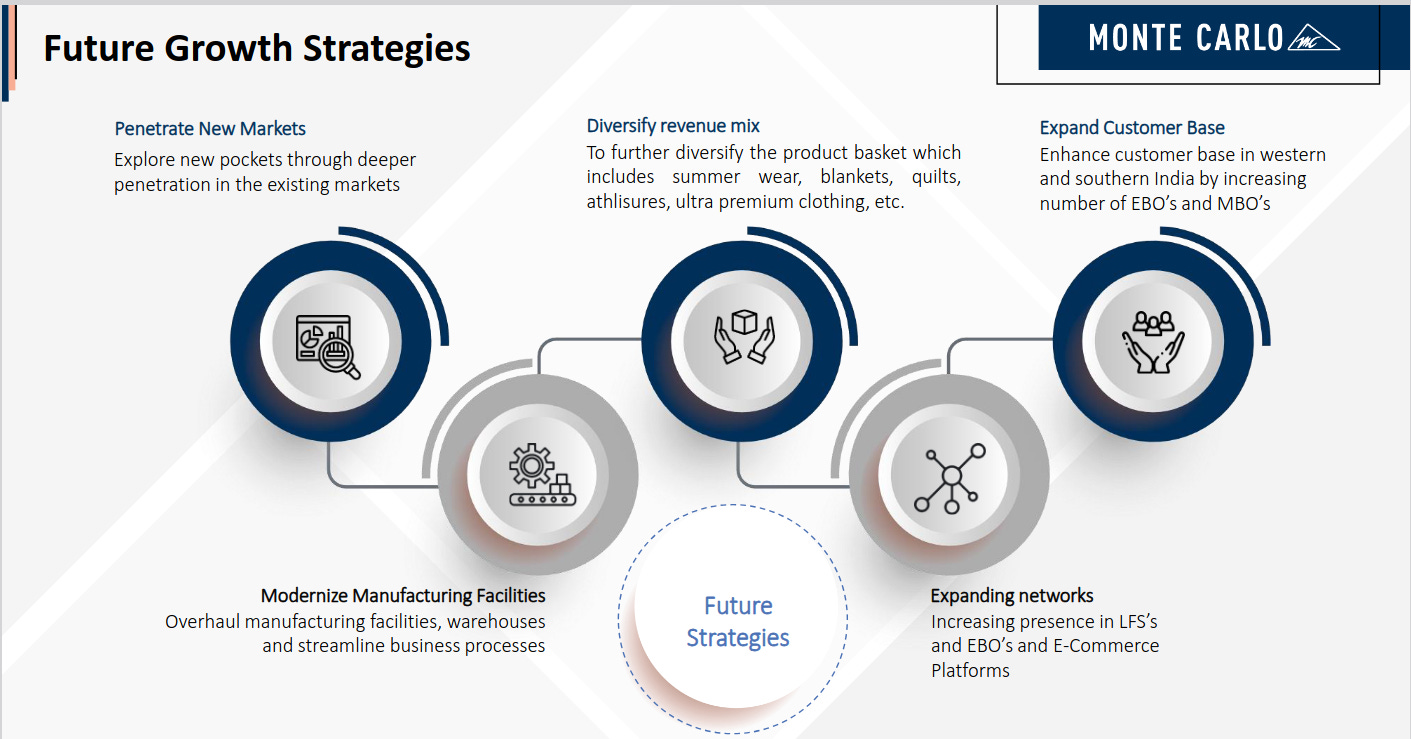

Monte Carlo Fashions | Micro Cap | Textiles

Monte Carlo Fashions Ltd manufactures and distributes men’s and women’s apparel. The company manufactures shirts, t-shirts, and sportswear. Monte Carlo Fashions Ltd was incorporated in 2008 and is based in Ludhiana, India. Monte Carlo Fashions Ltd operates as a subsidiary of Oswal Woollen Mills Limited.

Monte Carlo’s future growth strategies focus on five pillars: penetrating new markets through deeper reach, diversifying the product mix into summer wear, quilts, athleisure, and premium clothing, and expanding its customer base in western and southern India by growing EBOs and MBOs. The company also plans to modernize manufacturing facilities and warehouses to streamline processes, while expanding networks via large format stores, exclusive outlets, and e-commerce platforms.

Firstsource Solution | Small Cap | Software Services

Firstsource Solutions Limited, a leading player in the BPM industry, offers bespoke services across various sectors including Banking, Healthcare, Communications, and Technology. The company specializes in customer management services such as contact center operations, transaction processing, and debt collection services, including revenue cycle management for the healthcare sector.

The global business environment is being reshaped by three macro trends. Geopolitically, rising nationalism, tariffs, and trade barriers are driving demand for closer cultural and time zone alignment. Technologically, rapid innovation is reducing access barriers but increasing regulatory focus on AI, data privacy, and security. Anthropologically, longer lifespans are creating multi-generational workforces with deeper integration of digital and human employees.

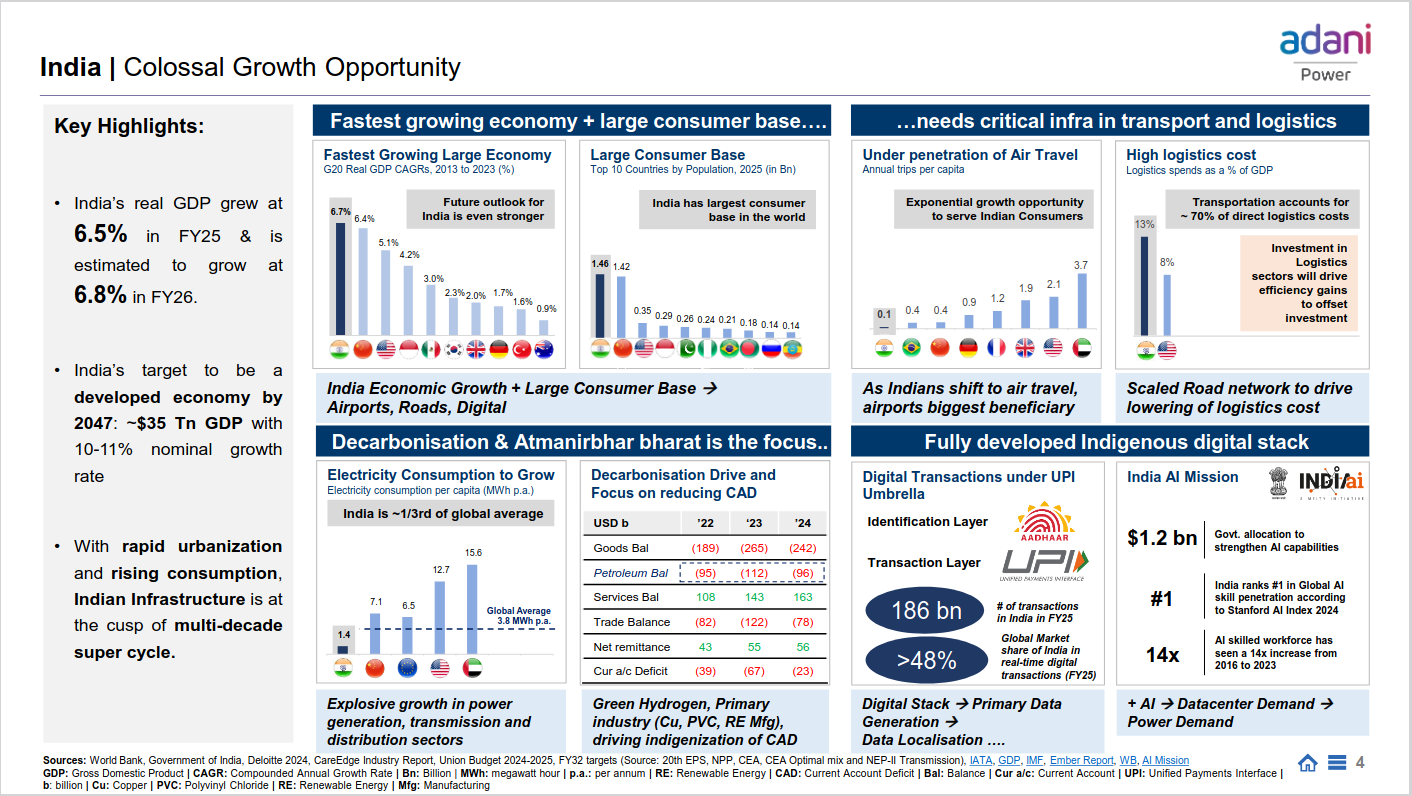

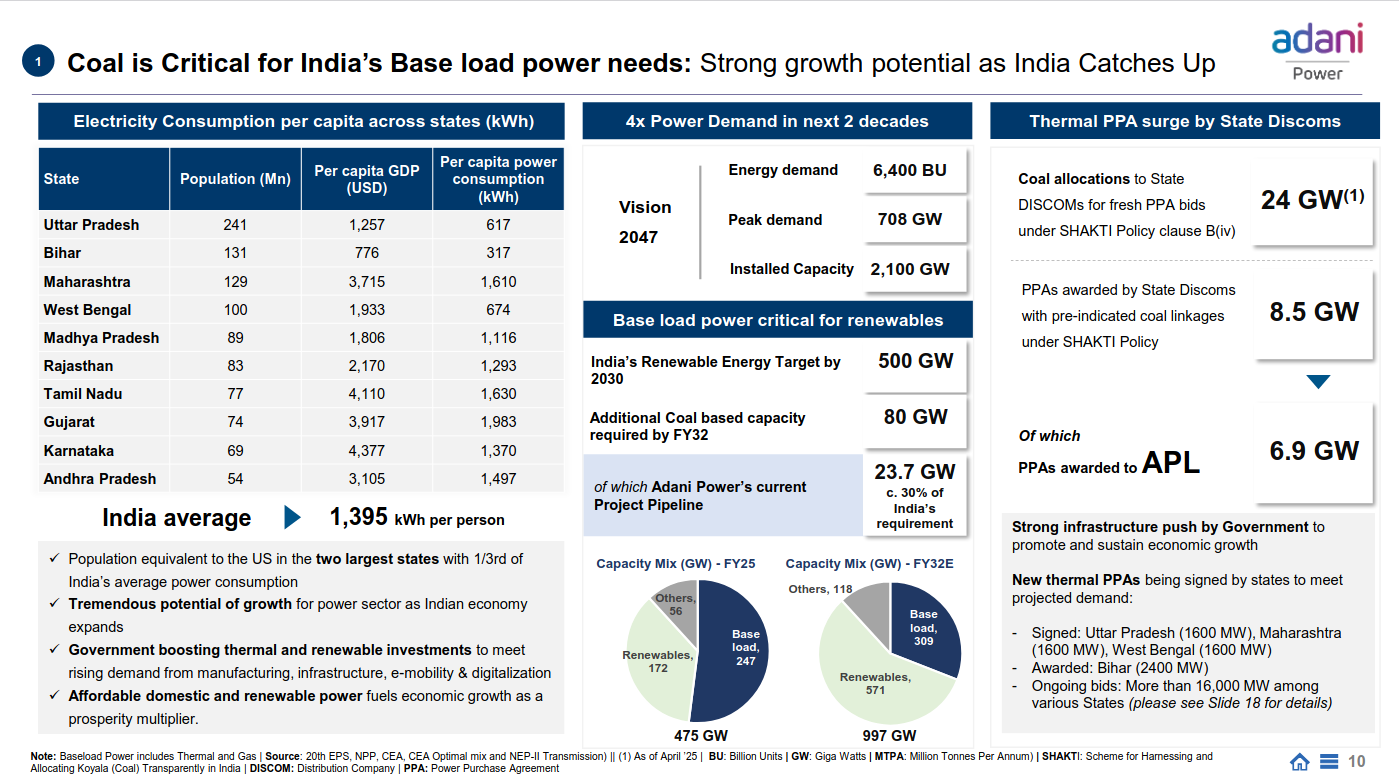

Adani Power | Large Cap | Energy

Adani Power Limited (APL) is India's largest private sector thermal power producer, operating across multiple states. The company focuses on leveraging technology and innovation to make India a power-surplus nation, ensuring the supply of quality and affordable electricity nationwide.

India’s GDP grew 6.5% in FY25 and is expected at 6.8% in FY26, with a target of becoming a $35T economy by 2047. The country benefits from the world’s largest consumer base, though infra gaps in logistics and air travel remain. Decarbonisation, renewable energy, and import substitution are key priorities, while India’s indigenous digital stack (UPI, Aadhaar, AI mission) is driving massive transaction growth and data-led opportunities.

India’s per capita power consumption (1,395 kWh) is far below global levels, highlighting strong growth potential as demand is expected to 4x by 2047. To balance renewable expansion (500 GW by 2030), 80 GW of new coal capacity will be added, with Adani Power’s pipeline at 23.7 GW (~30% of requirement). Thermal PPAs are surging, with states like UP, Maharashtra, and West Bengal signing large contracts, supported by government infrastructure push and affordable domestic power.

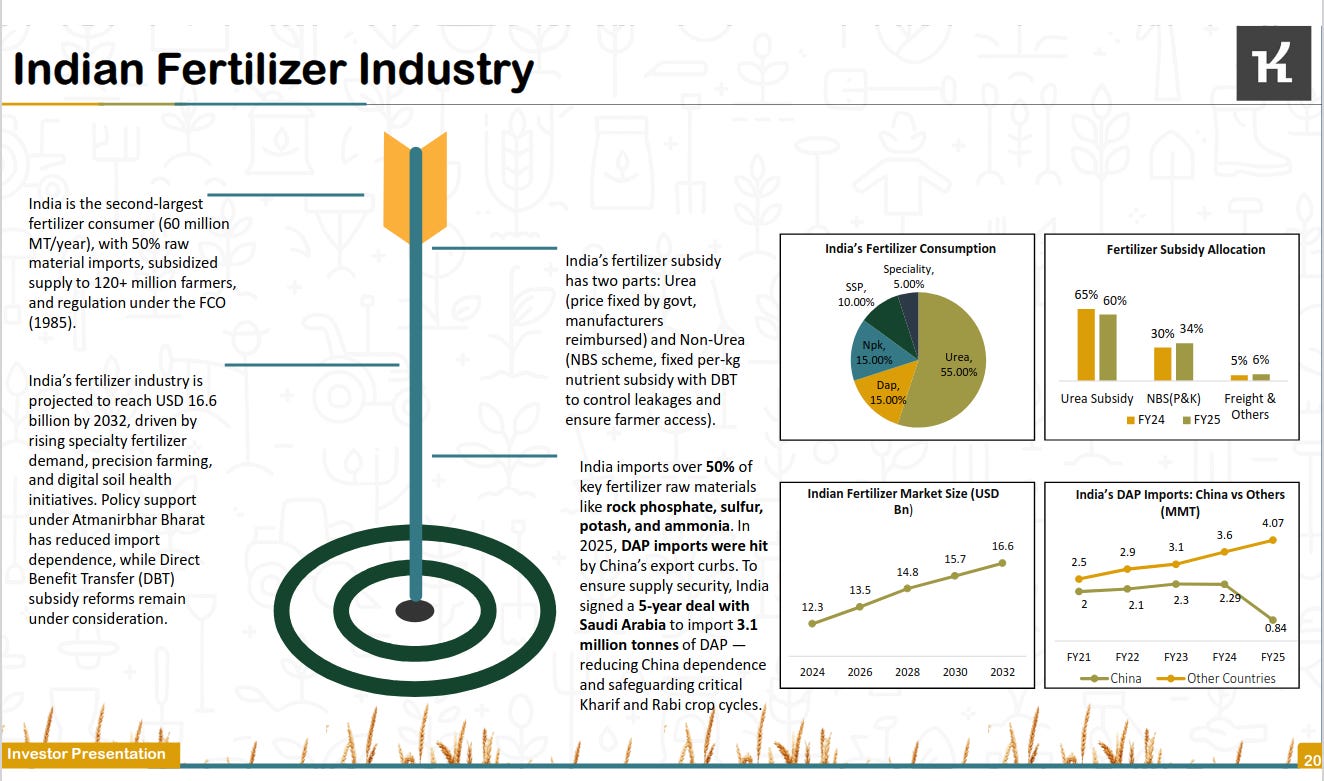

Khaitan Chemicals & Fertilizers Ltd. | Micro Cap | Fertilizer

Khaitan Chemicals & Fertilizers Ltd., an India-based company, is involved in the manufacturing and selling of single super phosphate and sulphuric acid, processing of oil seed and crude edible oil, selling of de-oiled cake and oil, and generation of wind power. The company operates in two segments: fertilizers & chemicals, and soya.

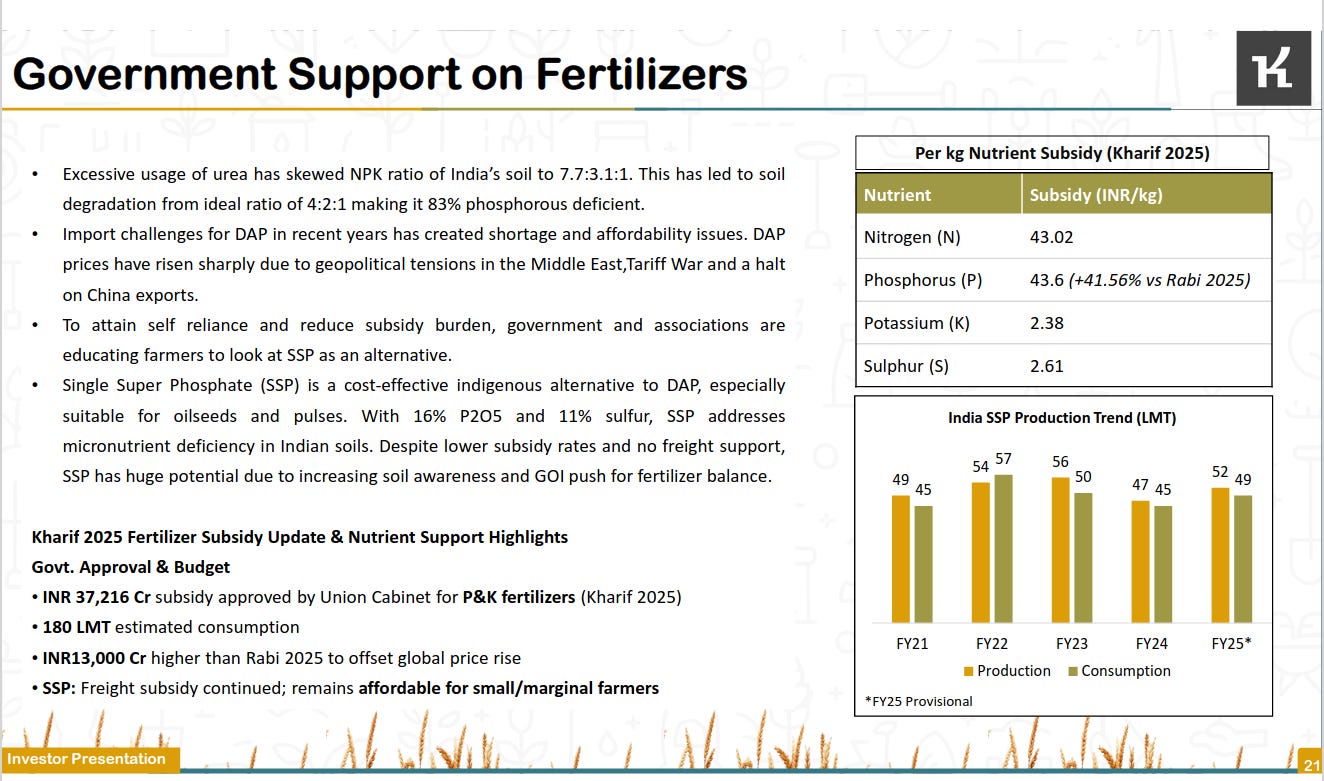

India is the world’s second-largest fertilizer consumer (~60 MT annually), with 50% raw material imports and subsidies reaching 120+ million farmers. The market is projected to grow to $16.6 bn by 2032, supported by specialty fertilizers, precision farming, and DBT reforms. Over 50% of key raw materials are imported, with recent DAP supply challenges leading to a 5-year import deal with Saudi Arabia for 3.1 MT. Urea dominates consumption (55%), while subsidy allocation is shifting more towards non-urea fertilizers.

Heavy urea use has distorted India’s soil NPK ratio to 7.7:3.1:1, creating severe phosphorus deficiency. DAP affordability is under pressure due to geopolitical tensions and China’s export curbs, pushing the government to promote SSP as a cost-effective, indigenous alternative for oilseeds and pulses. For Kharif 2025, the government approved a ₹37,216 Cr subsidy for P&K fertilizers with 180 LMT estimated consumption, including a ₹13,000 Cr buffer against global price spikes. SSP remains subsidized for freight and affordable for small/marginal farmers, with production and consumption steady at ~50 LMT.

Sun Pharma Inds. | Large Cap | Healthcare

Sun Pharmaceutical Industries Limited is a leading specialty generic pharmaceutical company in India, known for delivering high-quality products at affordable prices. With a diverse portfolio covering a wide range of therapies, the company manufactures and markets various formulations, including generics, branded generics, specialty products, OTC medications, ARVs, APIs, and intermediates.

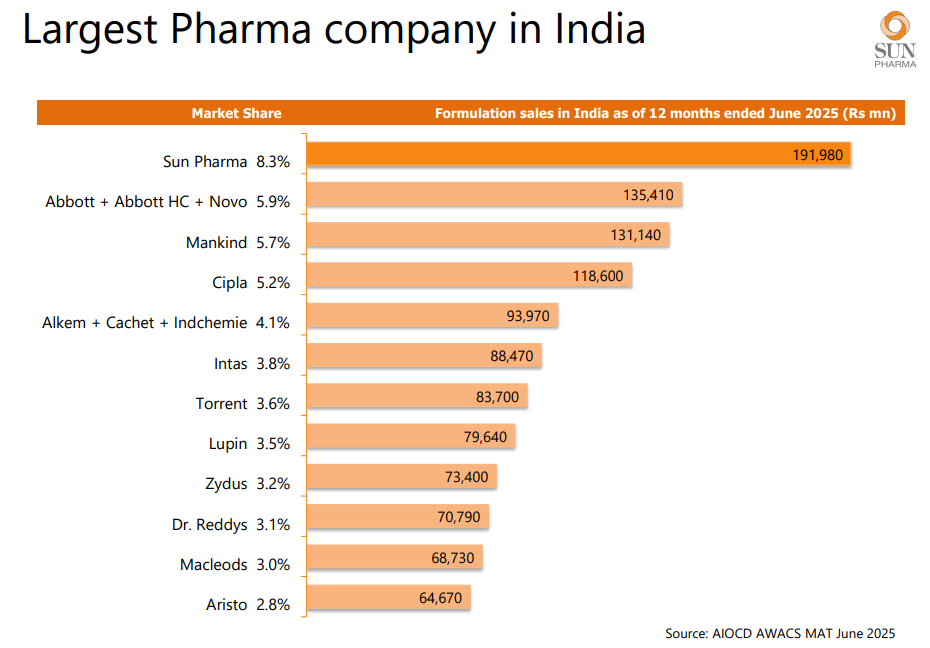

Sun Pharma leads India’s pharmaceutical market with an 8.3% share and ₹191,980 mn in formulation sales (as of June 2025), ahead of Abbott (5.9%), Mankind (5.7%), and Cipla (5.2%). Alkem, Intas, Torrent, Lupin, and Zydus follow in the mid-tier, while Dr. Reddy’s, Macleods, and Aristo round out the top 10 with 3%–3.1% share each.

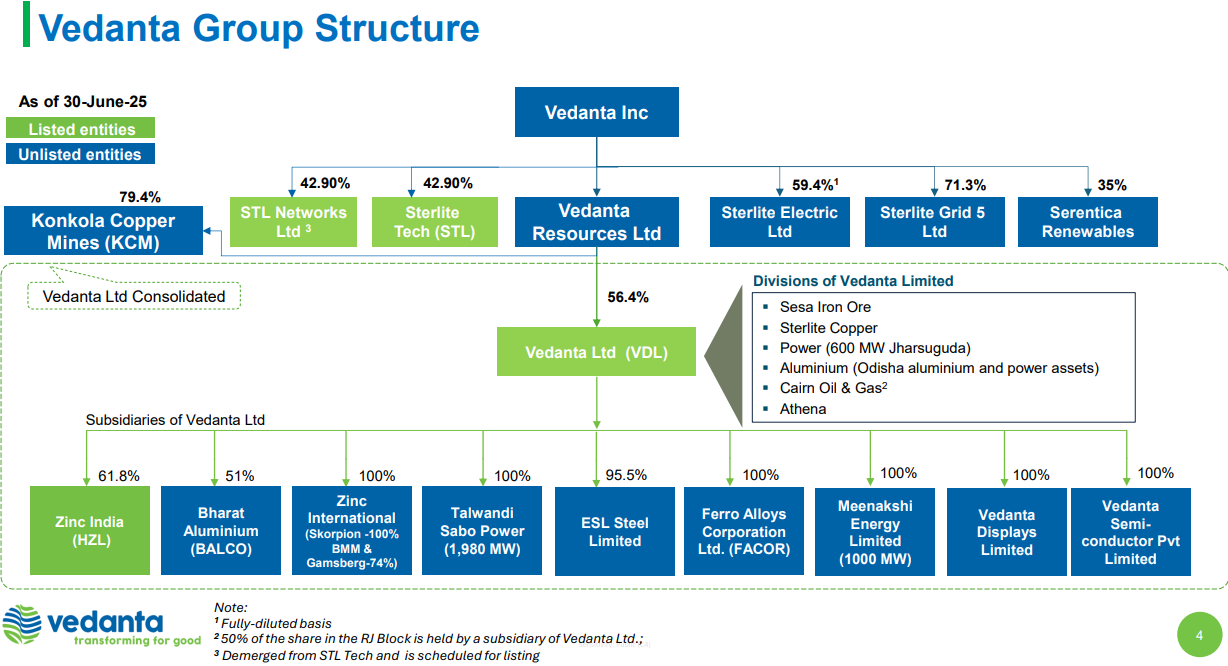

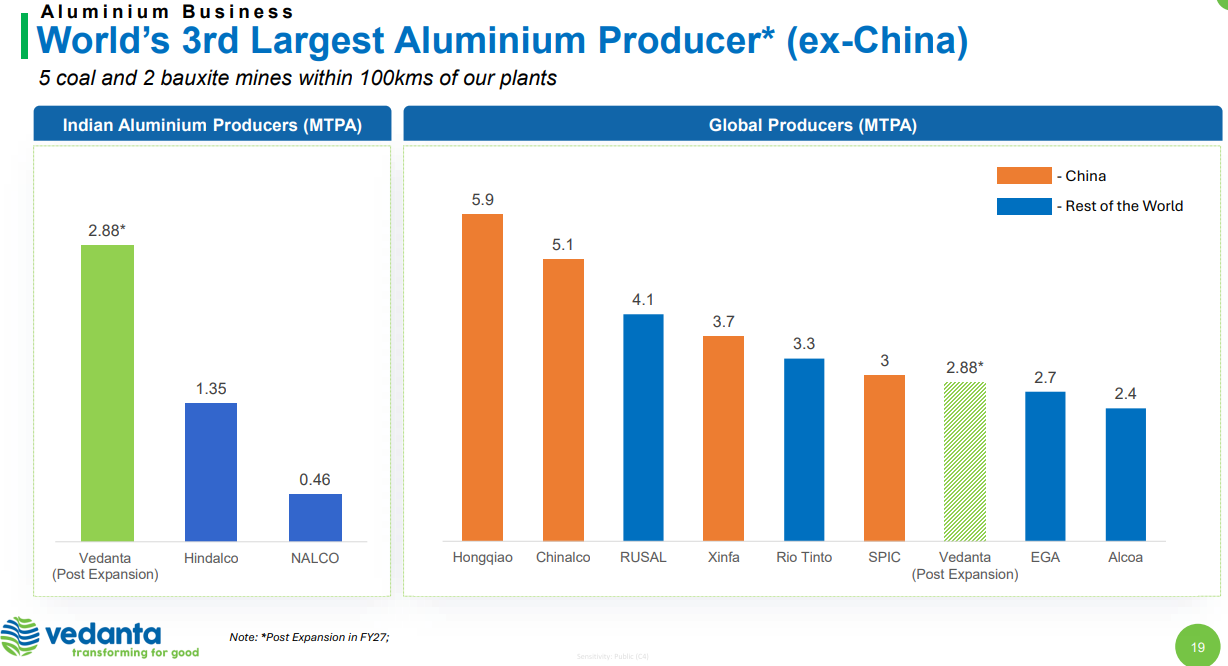

Vedanta | Large Cap | Metals

Vedanta Ltd is a leading natural resources conglomerate with operations in zinc, lead, iron ore, steel, copper, and more. The company focuses on creating value through strategic capabilities, alliances, and a portfolio of low-cost, profitable assets. It is a global leader in critical minerals and plays a key role in the energy transition by supplying essential materials.

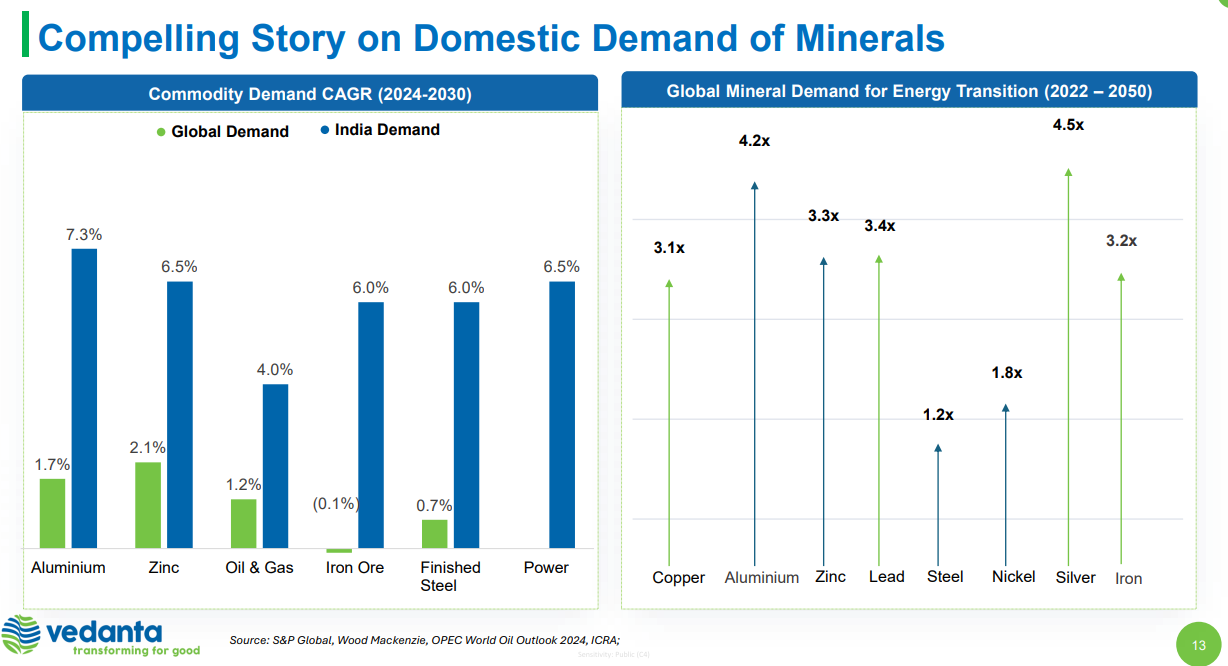

The slide reveals Vedanta's positioning at the intersection of two powerful demand drivers: India's commodity consumption growing at 3-5x the global rate (with aluminium at 7.3% vs 1.7% globally, zinc at 6.5% vs 2.1%, and finished steel at 6% vs 0.7% CAGR through 2030), while simultaneously, the global energy transition will multiply demand for these same metals by 3-4.5x by 2050, driven by electric vehicles, renewable energy infrastructure, and grid modernization.

At 2.88 MTPA capacity by FY27, Vedanta will be more than double its nearest Indian competitor Hindalco (1.35 MTPA), giving it pricing power domestically.

Also, the global producers chart reveals Vedanta's strategic positioning within the worldwide aluminium hierarchy, where Chinese producers dominate. Post-expansion, Vedanta's 2.88 MTPA capacity places it just behind major international players like Rio Tinto and SPIC, positioning the company roughly 7th globally and crucially, as the 3rd largest producer outside China.

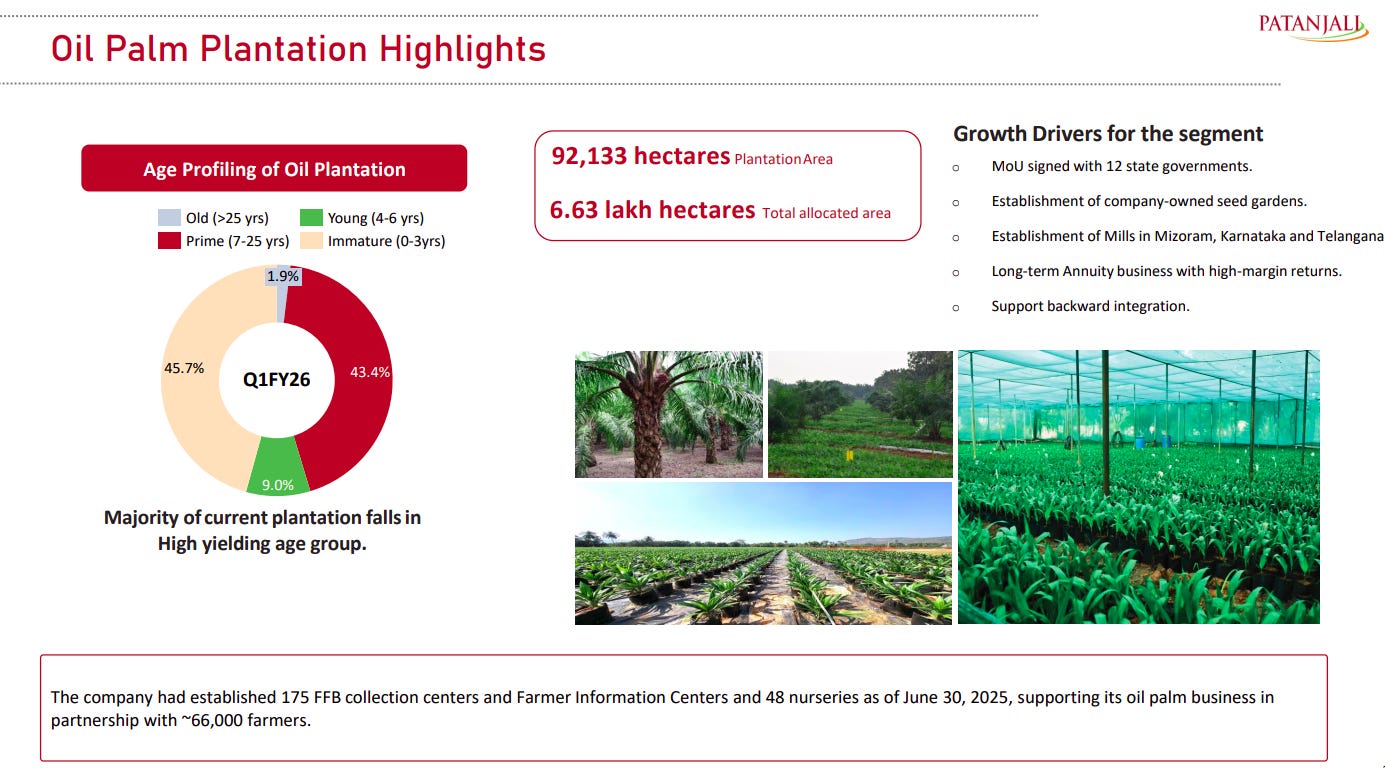

Patanjali Foods | Mid Cap | FMCG

Patanjali Foods Limited, formerly Ruchi Soya Industries Limited, processes oil-seeds, refines crude oil, and produces food products and value-added items. It also operates in FMCG and FMHG sectors with products like food, biscuits, and nutraceuticals. The company is involved in wind energy power generation, trading in diverse products, and has manufacturing plants throughout India.

Patanjali operates oil palm plantations across 92,133 hectares, with 6.63 lakh hectares of total allocated land. The company works with around 66,000 farmers through 175 collection centers and 48 nurseries. Currently, 43.4% of their plantations are 7-25 years old, which is the most productive age range for oil palm trees. They have signed agreements with 12 state governments and established processing mills in Karnataka and Telangana to support their expansion plans.

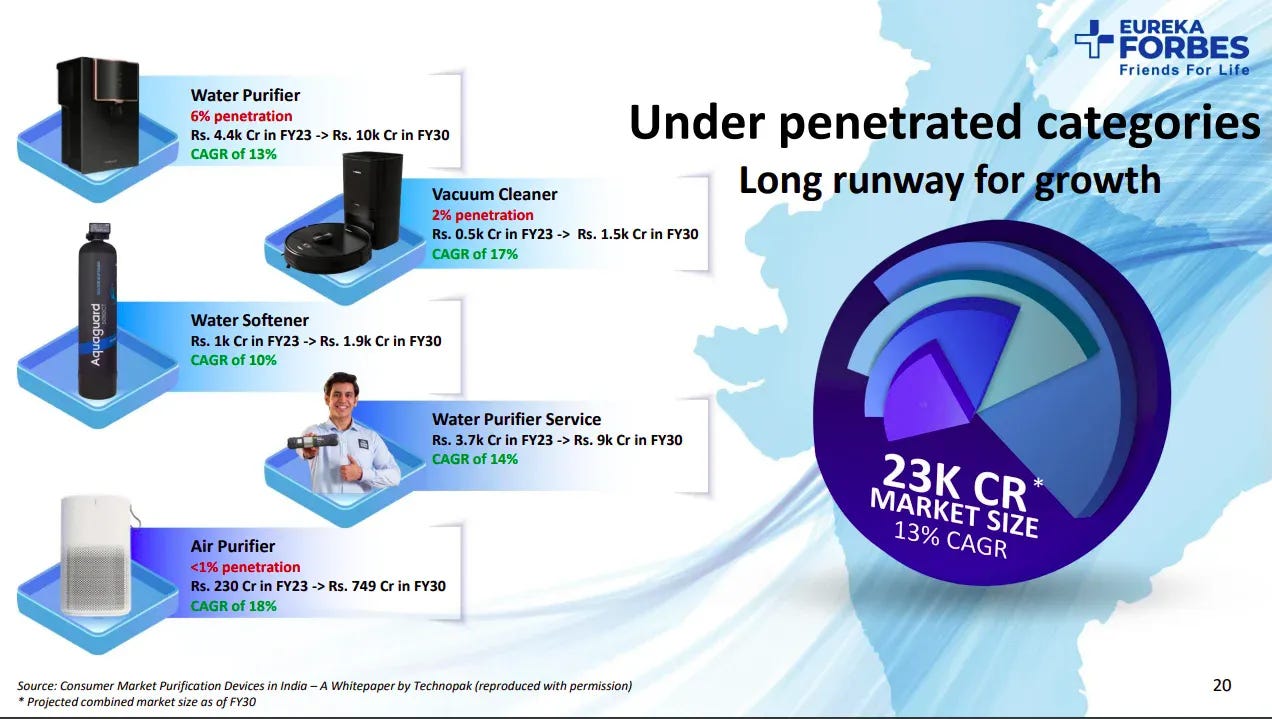

Eureka Forbes | Small Cap | Consumer Durables

Forbes Enviro Solutions Ltd is engaged in developing water projects and waste treatment plants. The company is based in Mumbai, Maharashtra. Forbes Enviro Solutions Ltd. operates as a subsidiary of Forbes and Company Ltd.

Eureka Forbes operates in several home appliance categories with low market penetration rates, indicating significant growth potential. Water purifiers have only 6% penetration despite growing from Rs. 4.4k Cr to Rs. 10k Cr (13% CAGR). Vacuum cleaners show just 2% penetration with the smallest market size of Rs. 0.5k Cr expanding to Rs. 1.5k Cr (17% CAGR). Air purifiers have less than 1% penetration but represent the fastest-growing segment at 18% CAGR, from Rs. 230 Cr to Rs. 749 Cr. The company also offers water softeners and purifier services, with the total addressable market projected to reach 23k Cr by FY30 at 13% CAGR.

That’s it for now! Your feedback will really help shape how Points and Figures evolves. Drop it down in the comments below!

Quotes in this newsletter were curated by Meher, Prerana & Vignesh.

Disclaimer: We’ve used AI tools in filtering and cleaning up the quotes from the images so there maybe some mistakes. Now, if you are thinking why we are using AI, please remember that we are just a small team of 5 people running everything you see on Zerodha Markets 😬 So, all the good stuff is human and mistakes are AI.

We just started a new experiment - Plotlines!

Plotlines is an extension of our Chatter newsletter. While most financial analysis focuses on quarterly results and near-term changes, Plotlines takes a different approach. We analyze executive commentary from earnings calls and investor presentations to identify long-term, structural shifts that will shape industries for years to come.

Instead of chasing headlines, we look for strategic pivots, evolving competitive dynamics, and fundamental changes in how companies allocate capital. Each week, we'll highlight the most significant "plotlines" from recent corporate communications, focusing on comments that signal permanent changes in market structure, technology adoption, or business models.

Points and Figures is run by the same team that creates The Daily Brief and Aftermarket Report.