Welcome to another edition of The Chatter. The response to the initial couple of editions was overwhelming and we want to thank you all for the encouragement, feedback, and suggestions. After hearing from all of you, we are quite excited about Chatter and we'll keep it going.

This edition is a little experimental and ambitious as well. We've significantly increased the number of companies we have covered and made a few small tweaks:

We now mention the market cap and sector of each company

We've also added links to our stock pages that give you a quick fundamental overview of the company.

We want your feedback on a few things:

Given that we've covered about 35 companies, is this too much? In our minds, this is unavoidable given that this is earnings season.

Should we cover global companies or get rid of them altogether?

Are there any other enhancements you want us to make?

Please let us know in the comments.

Also, we want to tell you that we won’t mind if you share this is with you friends. In fact, we dare you to :p

In this edition, we have covered the following companies:

Energy & Utilities

Engineering & Capital Goods

Chemicals & Fertilizers

Textiles & Apparel

Consumer Durables & Electronics

Jewellery & Accessories

Breweries & Distilleries

Automotive

Pharmaceuticals & Healthcare

Financial Services

Rubber Products

Media & Entertainment

Global

Adani Green | Large Cap | Energy

Highlights superior CUF at Khavda plant driven by advanced technology deployments.

(CUF, or Capacity Utilisation Factor, measures how efficiently a plant generates electricity compared to its maximum potential output.)

“The potential of Khavda can also be reflected from the fact that in the last quarter, the solar CUF was more than 32%. This all has been made possible because of the advancement in technology which we are deploying there, whether it's bifacial N-type modules, it's single-axis trackers, our robotic cleaning systems, all are playing their very important role in getting the maximum generation out from Khavda. Our relentless focus on execution, operational excellence, and technology is further cementing our leadership role in the renewable energy sector in this country.”

– Ashish Khanna, CEO

Addresses transmission infrastructure readiness and monitoring, critical for timely capacity addition.

(Without adequate transmission infrastructure, electricity generated from renewable plants cannot reach consumers, making production redundant.)

“We are expecting another 4 gigawatts to be added by June and 7 by the end of this year. I think this is an area where we are keeping a very close track on what's coming in so that our operational capacities can seamlessly flow from the evacuation capacities, which are being available. We are very happy to see the way the Ministry of Power is also monitoring these aspects, listening to us, mapping not only us, but other capacities too, and then making sure from there that the agencies who are entrusted with that work conform to the timelines which are expected from all the developers to commission their plant.

We have been trying, mapping our capacity expansion in line with what is promised to us, and not only promised, we are also looking at the reality which is happening at site. Like I shared with you, the capacity expansion in June and further on till December are going to help us a long way from our capacity expansion in Khavda, the way we have mapped it across. There could be a week here or a week there sorts of issues or a month here or a month there, but I think on an overall basis, it is on track, at least for us.”

– Ashish Khanna, CEO

Clarifies environmental challenges impacting FY25 capacity targets, confident of improved execution.

“Our assumptions with respect to the environment remain there, the soil conditions there, and the effect of rains beyond the months where it was raining—I think there was some effect to it, which has now been taken care of. These environmental aspects and our preparedness for the same is the prime reason. Once you have these impacts, then re-mobilization takes a short time, and sometimes it takes longer, because the labor has to come from outside. We are taking new initiatives to ensure we are much better prepared, incorporating all learnings from last year. That is why we are confident about adding 150% of our last year's capacity addition.”

– Ashish Khanna, CEO

Clarifies strategic stance regarding the ISTS (Inter-State Transmission System) waiver.

(ISTS refers to transmission charges waived by the government for renewable energy projects transmitting electricity across Indian states.)

“Regarding the point on the ISTS waiver, I think it's a generic question. We all know what the Government of India is currently taking its view on. We are also closely watching the situation. As you know, we are not the decision makers. We will follow that—the policies of it. Currently, our strategy is to go with the policies and not take any risk based on assumptions with respect to the ISTS waiver. That way we are insulating our organization from it. But if there is any change, of course, we will re-strategise accordingly.”

“The ISTS waiver gives additional value to merchant capacities and is scheduled to go off from June 2025. Capacities post-June 2025 have capabilities for serving the C&I market and pumped storage inputs.”

– Ashish Khanna, CEO & Raj Kumar Jain, Head of Business Development

Hints at potential plans for battery storage to exploit merchant arbitrage opportunities in spot markets.

Battery storage allows power producers to exploit pricing arbitrage by charging batteries during periods of low demand (when electricity prices are low) and discharging stored energy during periods of peak demand (when prices are high). This enables companies like Adani Green to capture significantly higher spot-market prices, thus enhancing profitability.

“Keeping our close watch on it. It's not that we are oblivious of this whole process of battery storage. There are lots of things which are happening within the company, and I think in the times to come, you will be one of the first ones to hear from us on that aspect.”

– Ashish Khanna, CEO

Clarifies position on signing PPAs; dismisses concerns of significant delays.

“Roughly out of the 9.6 gigawatt we won in the last year, about 6.25 gigawatt we have already signed up. The balance of roughly 3 gigawatt is yet to be signed. We are already in the process for that capacity as well—it's quite recent. From an exposure perspective, we do not have much capacity where PPAs are pending. Even within this 9.6 gigawatt, around 1.4 gigawatt has already cleared the LOA process.”

“I think it is not right on us to generalize about PPAs being delayed. From our standpoint, two-thirds of what we won last year has already been signed off as PPAs. The balance capacities are very recent, and I do not see much challenge, at least for us. We remain very focused on what we are doing in this process.”

– Raj Kumar Jain, Head of Business Development & Ashish Khanna, CEO

Waaree Energies | Mid Cap | Engineering & Capital Goods

Clarifies strategy to manage risks from potential U.S. tariffs on imported solar modules.

(The U.S. recently announced potential tariff changes on imported solar equipment, impacting module exporters globally, including India.)

"So, in the revenue stack at this point, anywhere between 17% to 20% is U.S.-bound, directionally. There's a substantial 80% revenue coming from the India market, putting us in a position to manage our EBITDA effectively. We have manufacturing facilities in both the U.S. and India. Based on how tariffs ultimately settle, we’ll decide production distribution between the U.S. and India, creating a natural hedge to control EBITDA.”

– Amit Paithankar, CEO

Clarifies the "book and build" strategy, highlighting secured order book as a basis for capacity expansion.

“Waaree has a philosophy of “book and build”. Let me take a few moments here to explain what we mean by book and build. So, we decide to build a factory only after we have confidence in the booking numbers. Once we book the orders and we know that we have to deliver, only then we go ahead and build the factories. And the factory that we have in the US, as well as the factories that we have, frankly, anywhere, including our Chikhli, which is the largest facility, is built on the back of a very strong order book. And so the confidence that we have, and that's the reason why we have been able to give the guidance, right, for our EBITDA, stems out of an order book, which we are very, very confident about. Our customers are clearly needing all of these panels and we are ensuring that we are able to deliver it to them. In fact, the execution need inside our organization now is to -- and since it's IPL season going on, is to really consider almost every day as an over and to make sure that we are actually hitting the manufacturing numbers every day to meet our customers' requirements.”

– Amit Paithankar, CEO

Shares insights on strong growth prospects in the DCR (Domestic Content Requirement) market, driven by government initiatives and export opportunities.

(The DCR market requires solar modules manufactured using domestically produced cells, supported by schemes such as PM Surya Ghar Yojana and PM Kusum.)

“One major segment in the DCR market is driven by PM Surya Ghar Yojana and Kusum scheme. Last year, demand was around 3 to 4 gigawatts. Given increased government allocation and spending, we expect this market to grow significantly to between 10 to 15 gigawatts this year. Additionally, a substantial portion of this capacity could also be exported to the U.S., as imports face more restrictions. Indian-produced cells are potentially better positioned tariff-wise to be accepted in the U.S. market. Thus, there are multiple avenues for utilizing our domestic cell production capacity.”

– Sonal Shrivastava, CFO & Amit Paithankar, CEO

Highlights the differing timelines and execution pace across domestic, export, and retail segments.

(Order execution timelines differ substantially across markets, with export orders typically having longer lead times.)

“I will tell you the velocity of orders for various segments keeps changing. For exports, it's always, like you rightly said, two years plus—typically two to three years. But for Indian orders, even large institutional customers, timelines tend to be shorter, around one to one-and-a-half years. Additionally, almost a quarter of our business comes from the retail segment, where the velocity of orders is even higher.”

– Amit Paithankar, CEO

Highlights increased global renewable energy demand driven by rising data-center and AI-related power consumption.

“One search on Google Gemini or ChatGPT in terms of watts is 10 times more intensive than a plain Google search. Now, even if you give a plain Google search, first Gemini gives you stuff and that is 10 times more than what Google used to do a year back. So that is and many majors, large IT majors who are setting up large data centers have clearly said that they are going to have all of this power coming from renewables. So worldwide, including the U.S. we are seeing a very, very substantial rise in demand.”

– Amit Paithankar, CEO

Explains how rising solar penetration, low daytime tariffs, and Discom reluctance to sign PPAs are increasing the importance of energy storage solutions.

(Renewables produce power intermittently—solar only during daylight and wind when it blows—which can stress the grid. This intermittency makes storage essential to maintain grid stability.)

“Like you rightly said, a solar panel produces electricity only when the sun shines; a windmill generates power only when the wind blows. Recognizing this challenge, the Government of India has mandated a minimum level of energy storage to accompany renewable energy capacity, a requirement likely to increase further. This will progressively make round-the-clock renewable power a reality. Grid stability will become increasingly critical, elevating the importance of battery storage, especially as battery prices continue declining. Going forward, new PPAs or tenders will increasingly combine renewable power with explicit storage requirements.”

– Amit Paithankar, CEO

Clearly outlines the levers to achieve the INR 5,500–6,000 crore EBITDA target by FY26.

“On the top line, I have INR 47,000 crores worth order book, which feeds all of my factories, and my factories are completely booked till 31st March 2026 and beyond. This provides the necessary fodder for our production of solar panels. As we scale up, we benefit significantly in cost management, both in manufacturing and SG&A expenses, giving us substantial leverage. Furthermore, as scale increases, manufacturing becomes more efficient, improving capacity utilisation and moving us closer to our plants' rated, or nameplate, capacities. These combined factors are precisely the levers we will pull to achieve our targeted EBITDA of INR 5,500 to 6,000 crores.”

– Amit Paithankar, CEO

Tata Chemicals | Mid Cap | Chemicals

Management was explaining the demand drivers across geographies, highlighting that China’s past surge was driven by solar and EV battery demand, while India’s steady domestic growth remains a bright spot.

“Last year was a year of very strong growth in China. We don’t expect similar growth to continue this year. Last year was about 18% growth, mainly solar and lithium carbonate markets. We don’t expect because usually we expect about 6% growth. So we are actually factoring in that China will probably remain stable or maybe have a negative of 1 1% or so. So it’s going to be somewhere stable in my view. So that’s what we are projecting into our plan. India will continue to grow and we are seeing very good traction of growth in both glass and all other segments in India and we are at least factoring anywhere between 5 to 6% growth in India even in the coming years and Indian economy and Indian demand is one of the steadiest we will see for the next couple of years.”

- Arun Mukundan, Managing Director and CEO

Noted that while tariffs could shift global trade flows, Tata Chemicals hasn’t yet seen meaningful impacts on its operations.

“We have not factored any of the major issues around tariff. It may lead to rebalancing of supply demand centers and as of now from the centers we manufacture we have not seen a major shift in the way we need to rebalance our market portfolio.”

- Arun Mukundan, Managing Director and CEO

Vedant Fashions| Mid Cap | Textiles

They plan to pivot toward faster, digital-heavy marketing, breaking from traditional offline-heavy spending.

“I think what we are now strategically taking a call on is is there a high need to be 100% digital and to have a lot more focus on how campaigns are done uh with rapid speed and instead of one or two big campaigns doing 12 to 13 mini campaigns. So this is something which we’ve been discussing quite heavily on and uh I believe this is something we will be going after and really changing the way model marketing has been functioning.”

- Vedant Modi, Chief Revenue Officer

Older competitors are pulling back, but consolidation timelines remain unpredictable as new entrants continue expanding.

“What you know we have witnessed in our tracking is that people who’ve been a lot older competitor of ours in terms of being in this market have had a reduction in the number of stores they have from last year to this year. So the legacy competitors we’ve seen the number of stores go down compared to last financial year. Uh but on the same hand what we’ve seen is uh the other newer players adding the stores.”

- Vedant Modi, Chief Revenue Officer

Management highlighted that this is an unprecedented wave — and hinting that execution complexity (not just capital) will crush weaker players.

“We’ve certainly witnessed competition in the last two decades of us operating this brand. Nothing at these levels for sure. U and typically what we’ve noticed is people open up a single store in a city do decently well uh and and as they sort of scale up to a state level to a region level that’s when things start to go south. Uh this industry has to understand the hack of you know sort of understanding consumer preferences and understanding data at a very deep encode level because what works in one part part of the city does not work in the other part of the city. This is what has been our core mode over the last few years and continues to be.”

- Vedant Modi, Chief Revenue Officer

Signals a “fix before growth” mindset, avoiding the common trap of chasing expansion when fundamentals are soft.

“FY26 uh is is one financial year where we will take some hard decisions wherever it’s needed on account of higher rentals where we have newer stores next to it. So wherever whatever decisions are required we will take those. U however at a at maybe third quarter onwards I think we are quite sure of you know getting back on decent retail area growth and most importantly one thing which I want to you know sort of bring some light on is quality retail area will grow tremendously from a complete financial year perspective.”

- Vedant Modi, Chief Revenue Officer

Blue Star | Mid Cap | Consumer Durables

April RAC growth was only ~5% vs. internal target of 25-30% and industry's 15-20%, due to high channel inventory and unseasonal rains. Raises concerns about Q1 performance against a high base.

"Now, April had not been a month which delivered in line with that outlook. First problem was in March itself, materials were lifted in significant quantities, which resulted in, in my estimate, more than 4 million units in the market. In my view, it was anywhere between 1.5 million to 2 million more inventory than what should have been there. And then there were sporadic rains across the country, including Mumbai for the past few days. And April sales would have been, I understand the industry would have grown anywhere between 15% to 20%. In our case, as I can disclose this since the board meeting is over, we would have grown by around 5%. Our own internal target was to grow by 25% to 30%, because if industry is growing between 20% to 25%, we wanted to grow by 25% to 30%."

- B Thiagarajan, Managing Director

Confirms the commercial refrigeration segment faced headwinds from regulations in FY24, remaining flat in Q4, but is now seeing significant growth recovery starting April FY25.

Two major regulatory changes impacted the industry: stricter energy efficiency norms and the phasedown of HFC based refrigerants.

“Now, it's an all-round performance, except for the commercial refrigeration business, the performance of which was impacted due to regulatory changes which we had disclosed to you in Q1 itself. These are regulatory changes that continued and the business has recovered and it had been somewhat flat compared with last year in Q4.”

- B Thiagarajan, Managing Director

Blue Star confirms it has provisioned for potential liabilities related to Extended Producer Responsibility (EPR) rate hikes and FTA-related copper duty disputes. Significant copper localization is happening via Hindalco MoU.

"And you might have read about an article about e-waste, extended producer responsibility. Companies are filing suit against the government for increasing the rates. Blue Star has also filed a petition. The question here is whether the revised rate, when it came into effect, was provided for or not. There are companies which would have provided for it, and there are companies which would not have.

Next, you would have read an article—or many articles—about copper duty, whether it is under FTA and whether localization has happened. The good news is localization has happened, and we have signed an MoU with Hindalco for sourcing locally. A significant amount of material next year should be coming from within.

Now, in the last financial year, we would have imported copper. Again, there's the question of whether the FTA-related disputes have been provided for or not. These are all business as usual. Some companies would have provided for it; some would not have.

But as far as Blue Star is concerned, what needs to be provided for has been provided for. For example, in the e-waste matter, we have provided for that additional money, and if the court case goes in our favor, we will write it back. That’s how life will go on."

- B Thiagarajan, Managing Director

Highlights key growth drivers for the high-margin MEP [Mechanical, Electrical, and Plumbing] business: data centers and manufacturing benefiting from government initiatives, offsetting muted demand from commercial real estate (like office buildings) /infra (like metro stations, airports, etc.)

"Coming to electromechanical projects business, continuing with the trend of the previous quarters, this quarter also witnessed strong order finalizations primarily from factories and data center market segments. The commercial real estate and infrastructure market segments saw muted demand. The focus remains on faster execution of projects with healthier profitability and cash flow.

The company is hopeful that growing data center investments and focus on manufacturing will result in fruitful opportunities in FY26.

The carried forward order book of the business stood at ₹4,755 crores as of March 31, '25 as compared to ₹4,344 crores as of March 31, '24, a growth of 9.5%.

Coming to commercial air conditioning systems, the commercial air conditioning business delivered a good performance this quarter by maintaining its market leadership and improving profitability."

- Nikhil Sohoni – Group Chief Financial Officer

Polycab | Mid Cap | Engineering & Capital Goods

Polycab says low and medium voltage cables are driving most demand, but demand for high voltage cables is also strong, with renewables and power projects creating big opportunities.

“See, since low voltage and medium voltage combined are almost 50% of the overall market. I think the the kind of demand momentum witnessed over there will have the maximum impact as far as the industry growth is concerned as well as the growth of larger players like us is concerned. uh uh so that is obviously the primary uh uh type of cables which is driving the demand uh growth but uh even high voltage or EHV cables the demand for those type of cables is al also pretty strong as far as industries are concerned across all the types of industries we have seen consistent good demands power industry is one such industry wherein we have seen an improvement in demand and we expect this to be a consistent phenomenon going ahead especially the transition to renewable energy sources is something which is uh uh which is very very uh big opportunity uh in the country and for manufacturer cycles and we are trying to tap as much of that opportunity as possible.”

- Gandharv Tongia, Executive Director and CFO

Polycab plans to grow exports from 6% to 10% of revenue under its Project Spring strategy.

“As far as our performance on exports is concerned, we expect a material improvement uh going ahead uh every year. Within project spring, we have anyways laid out a guidance that we would want to increase the contribution of exports to the overall revenue to 10% from the current 6% that we saw in FY25.”

- Gandharv Tongia, Executive Director and CFO

Polycab believes India will gain relative advantage from global tariffs, as its rates are lower than those of other Asian exporters.

“If you look at the tariffs which are expected to get levied, India tends to benefit by because the tariffs are relatively lower than the other larger cable exporters from Asia.”

- Gandharv Tongia, Executive Director and CFO

US sales have dropped sharply but Polycab expects a recovery once tariff clarity improves.

“As far as this year is concerned, the contribution of uh US of our overall sales would be in uh high teens. Last year it was very close to 40%. [of total exports]] There is a bit of an uncertainty because of the tariff related announcements probably and hopefully it should get resolved very soon in the next couple of months and And I think we believe there should be an much better improved momentum as far as sales to us is concerned.”

- Gandharv Tongia, Executive Director and CFO

CG Power | Large Cap | Engineering & Capital Goods

They’re doubling transformer capacity to 85,000 MVA by FY28 to meet booming domestic + export demand.

“The board of director also approved a green field expansion of 45,000 MVA for power transformer capacity with the investment of 712 crores which we already declared. This will increase our overall capacity to 85,000 MVA by financial year 2728 and this expansion is considered to be expected uh demand in the transform industry both in domestic also cater to the exports market.”

- Amar Kaul, MD & CEO

Management reported rising motor order volumes driven by new products and export push, though revenue conversion lags.

“So everything is happening in tandem and that’s what is showing us increase in the in the in the volumes in terms of orders not really fully on the on the revenue right now.”

- Amar Kaul, MD & CEO

Management explained that semiconductor subsidies will follow the PLI scheme model, with full commissioning expected over the next couple of years.

“So in respect of your first question about how the money is coming from the government, it’s based on the pari passu — hope you understand the meaning of pari passu, right — it’s not about that we invest and the money comes in from the government, it’s all about pari passu. In case of the capex investment for CG Semi, we are thinking probably that the commissioning of this project will happen in the next couple of years, the entire commissioning of this project.”

- Amar Kaul, MD & CEO

Copper price inflation is hurting motor margins, and they can only partially pass it on.

“So fair point as you know that for motor business uh one of the raw material is copper and that has been uh not behaving very nicely. So if you look at the indices uh it’s gone up substantially. So some bit of it yes there’s a discipline way of balancing what can we pass on to the customer. Uh unfortunately commodity is on the rising trend.”

- Amar Kaul, MD & CEO

Radico Khaitan | Mid Cap | Breweries and Distilleries

Radico Khaitan's management firmly reiterated its premium pricing strategy amid the free trade agreement with the UK:

"Radico has always, if you see our track record in the last few years, believed in pricing all our products above the market leader in every category, irrespective of the price position for international brands or any other brands in India. The example is very clear. If you see the pricing of Jaisalmer, Royal Ranthambore, Rampur, we are priced much ahead of the competitors. We are creating a portfolio of the best Indian brands, and therefore we do not anticipate any change in our pricing strategy or price positioning."

– Amar Sinha, COO

Radico's management reported a significant reduction in inventory and receivables, leading to a 114% year-on-year reduction in debtors for Q4. This reflects a clear focus on improving cash flow and reducing working capital requirements:

"We have seen significant liquidation of inventory in Q4. Furthermore, we have also realised significant debtors towards the end of the quarter, resulting in a debt reduction of 114% over last year."

– Dilip Bantia, CFO

The company noted that the market has shifted significantly, with organized players now accounting for 60% of the market, compared to 40% for local competitors—a complete reversal from the previous year.

"We are the largest players, and this actually supports the point that the consumer there was looking for national and organized players to come in. Our market share in Andhra Pradesh, which was 10% in the first half of the year, grew to 17% in Q3 and reached 23% in Q4. This demonstrates the growing strength of our portfolio and our ability to capture market share in a rapidly evolving landscape."

– Abhishek Khaitan, MD and CEO

Management emphasized that this improved cash flow will allow the company to reduce debt, optimize working capital, and focus on long-term profitability growth.

"Going forward, our focus will be on driving profitability growth, along with cash flow generation and more efficient working capital management, resulting in debt reduction. This disciplined approach to financial management is a key priority as we continue to strengthen our balance sheet."

– Dilip Bantia, CFO

United Breweries | Mid cap | Alcoholic beverages

The company points to how, during elections, the Model Code of Conduct and related restrictions can suddenly hurt an alcobev company’s sales and market share — acting as an unusual source of volatility.

“Let me be very honest with all of you. Because of this capacity and election things, there were 3 states, we lost double-digit market share and for only reason, we could not supply in those states or manufacture in the States.

So we lost almost 10 points of market share in Telangana because we did not get the third shift approval during election code of conduct. And we are the biggest player, and we could not produce and couldn't supply. And we lost that market share all in 1 month in April and May during that election period. In June, we are back on track on the market share. In July, we are actually ahead on this.

But again, the second state we lost market share was Rajasthan, where again, both our breweries are running on capacity and we could not import from other states because of the election restriction.

And Odisha was the other states where we have 70% market share. We lost -- the category grew 50% in May. And because of the election restrictions again, we did not get permission from Andhra Pradesh or some of our other breweries to export there. So we did lose almost 200 basis points of market share, but it was very isolated to the states where we could not supply because of election restrictions either in local manufacturing or getting these stocks.”

— Vivek Gupta, MD & CEO

And also:

“... because we are a national business and a national brand, usually, we actually move almost 15% of our volumes from 1 state to another. So there was a significant reduction of that because the states did not issue export permits because of election code of conduct guidelines.

I'll give you a very simple example. We move our stocks from Goa to Andhra. The election submission said, no, we will not give you the escorts to move with the trucks and so there was a restriction. There was a restriction, for example, in giving us third shift permits in Telangana, for example.

If you remember, at this time, the Election Commission of India said there are some states where alcohol is more, some states where other things are more and they had more restrictions around that. In some cases, it got impacted because of higher number of dry days or restrictions when the election is happening in phases, you close the dispatches at 2 days before on the election day. And when you are the largest player, it impacts you more.”

— Vivek Gupta, MD & CEO

The company pointed to how beer bottles are more valuable for the company’s brand equity.

“... bottles bring a very different value to the brand and the experience on the beer market. So we decided that we will be consumer-focused. Where the cans are growing, where there is the demand of cans, we will invest in the can lines, we'll also expand our capacity on the cans. But we will not look at from an only profit angle that it is easier to sell cans. Because, long term, it actually erodes your brand equity because the bottle bring a different experience…

“... But yes, there is a trend because of lack of stores that cans are easier to carry and also easier to store. But we are also careful that we are not orchestrating that too much. Because if we do that, there is an experience of beer in a bottle with a certain branding and certain experience — we don't want to lose that also.

So especially, for example, if you go to an on-trade channel… if you go to a bar, very rarely you will actually get people serving you beer in a can, right? It will either be a draft or in a bottle. The experience of socializing, which is attached to beer, which we also don't want to fully lease.”

— Vivek Gupta, MD & CEO

The company highlighted the importance of investing in fridges for better beer sales:

“... I see the drivers of the category was not invested in. A very simple, the beer is sold and it is cold. It is basic But UB, when I see today have only 15,000 to 20,000 stores where we have fridges, where we sell the cold beer with our branding and everything to put together on this.

And this dropped significantly for the category if you go to Tier 2, Tier 3 town. We plan to triple up that investment in fridges in the next 12, 18 months. So the depreciation of capex and all of this thing -- it will be a capex investment.”

Bharat Forge | Mid cap | Engineering and Capital Goods

Bharat Forge is looking to diversify its business over the years. It’s leading this initiative with a foray into aerospace:

“... the business is becoming more diversified and resilient over the 2019 to 2025 time frame. Industry exports have been flat at around 1,600 crores despite oil and gas declining from around 1,100-1,200 crores to about 400 crores. This drop has been compensated by other areas such as high horsepower and aerospace. Aerospace is now 15% of industrial exports. It has grown 4x in the past 5 years, and we expect this to continue growing at a high pace going forward. We're now setting up a new dedicated forging and machining facility for aerospace backed by both business wins and customer commitments including uh financial uh commitments. You will witness one new business adding to the growth of industrial exports in the next 3 to four years overseas.”

- Amit Kalyani, Vice Chairman & Joint MD

The company’s management is cautiously optimistic on the question of tariffs:

“Nobody has an answer right now. I think we all have to wait and watch. What I’m convinced of is that as a manufacturer we have the right products, the right technology, a very good cost structure, and extremely strong customer relationships. We will tide over this situation both as a company and as a country. I think India will be in a neutral to advantageous position vis-à-vis many other places, and this should give a significant opportunity to Indian companies to both manufacture in India and to partner with global companies for mutually beneficial opportunities.”

And also:

“At this point, there's clarity that tariffs will be applicable only for the passenger car segment... we are engaged with all our customers... and all are talking positively in terms of taking over the tariffs from our side... We don’t think we’ll be exposed.”

- Amit Kalyani, Vice Chairman & Joint MD

The company points to electronics manufacturing as its next big foray, pointing to an expansion away from metal forging.

“I think that electronics are going to be a very large part of the overall industrial landscape. If you look at automotives also, the share of electronics in the automobile as a percentage of total vehicle value is dramatically increasing. So if you want to be in electronics, you can't only be in one or two areas. You need to build scale. You need to build supply chain capability. You need to build competence. And I think we're going to do that in multiple areas. And the Indian government wants to create Indian electronics players in niche area where imports are not wanted to be sed. So I think there is an opportunity and that's what we're pursuing.”

- Amit Kalyani, Vice Chairman & Joint MD

The management points to the opportunity in selling artillery guns to the government.

“This is only a phase one order which is 307 guns of which we have 60%. Overall India needs more than 1,500 — close to 2,000 artillery guns.”

- Amit Kalyani, Vice Chairman & Joint MD

United Spirits | Large Cap | Alcoholic beverages

Highlights importance of India-UK FTA for the company, since USL sells a lot of imported like Johnnie Walker, Black Dog, Smirnoff etc.

“We welcome the historic agreement between UK & India. Our congratulations to Prime Minister Modi and Prime Minister Starmer. The landmark treaty will enable improved accessibility and choice of scotch for the Indian consumers, the largest and most exciting whisky market.”

- Praveen Someshwar, MD & CEO

Titan Company Limited | Large Cap | Jewellery

Amidst all the discussion around how lab-grown diamonds are overtaking natural ones, Titan offers an important clarification. It’s true that customers are less likely to go for large diamonds — and they aren’t seeing those as an investment. But there’s actually a big surge in customer demand for smaller stones.

“... some of our high lifetime value customers are all feeling gold is certainly the flavor at this point in time. And they have no hesitation in buying gold, whereas they may have some hesitation in buying these solitaires.

On studded small stones, I don't think this story is at all playing out the way we might be imagining, — and that is more than 90% of our studded. So, different story sitting here and different kinds of segments.

… And by the way, on the solitaire side, smaller stone sizes, we are seeing a whopping increase in buyers. And at overall level, studded buyers is outpacing gold buyers. Whether solitaire or otherwise. Since not now, but the last two quarters — and it carries on into this month. April month also, it has been that way. So actually, at a buyer level, the story is different from the value-level that you are seeing.”

— Ajoy Chawla, Managing Director (replacing Mr. CK Venkataraman), Titan

Titan’s holding off on entering the lab-grown diamond space. In its view, at the moment, prices are falling rapidly, and it expects things to carry on that way.

“So, I can share with you what I have picked up about the retail and wholesale prices of LGD.

Most certainly, the wholesale price was anyway coming down continuously, and it continues to drop. And I think that will not stop, because even automation will happen and many other tech developments and productivity developments will push costs down like any tech product.

But interestingly, even on the retail side… many of the players were retailing LGD products at roughly ₹60,000 to ₹50,000 a carat. That has now come down to ₹30,000 for many players, barring one or two players who have continUED to retail it at ₹60,000. And there are new players coming in all the time. So, our estimate is that the market will continue to drop the retail price of LGD per carat, and that will make it much, much more affordable.

And I'm not sure how the unit economics is going to play out for a bunch of these players, unless we see a large number of totally new buyers coming into studded. Which, of course, if it happens, is great news for the industry, overall. So, it is a choppy situation.

But nevertheless, even at ₹30,000 rupees a carat retail price, the markups are quite healthy. So, I suspect there will be more price warriors who may come in.”

— Ajoy Chawla, Managing Director, Titan

Titan’s management has very interesting comments on how customers are adjusting to lower gold prices. Lower-value customers are willing to buy lower karat gold, while high-value customers are buying simpler products to save on making charges, while still buying enough gold.

“We are seeing — in the sub-Rs.50,000 price band, very specifically, more in gold and a little bit in studded also — there is an impact on the consumer sentiment there. Now, some of it is us vacating price points, because, simply, gold price goes up, the same product goes into a certain higher price band. That is one part of the story.

But there is continued, let's say, customer sentiment in that lower price band, where we are seeing some buyers being a little reticent.

Second piece is, yes, customers are more open to 18-karat gold. Though we don't really have the full information as yet. We've just launched some collections in 18-karat gold in certain parts of the country for traditional customers as well. And we hope that we'll see good response.

And I know that in CaratLane, we've launched something in 9-karats as well. So there is early traction and I think more and more customers are going to be open to lower karatage simply because the price point has become quite a bit.

On the higher price bands, while there is buyer growth, we are seeing some of the customers actually scaling down the complexity of product they are willing to buy. So, it means that if earlier they were open to buying a higher making charge product, they are sliding down a bit. But they are still buying a certain quantum of gold and a certain value.”

— Ajoy Chawla, Managing Director, Titan

The company talks about how it’s dealing with rising gold prices, and what impact that has on its balance sheet. Note: GOL, or gold-on-lease, is an arrangement where a company ‘leases’ gold, paying interest, rather than buying it outright. Because it’s committing less money, this puts less pressure on the company’s working capital.

“If gold price continue to rise like this, while we have some levers of increasing our GOL-level, etc., it would certainly require some more capital investment from our side. And for which our balance sheet can be leveraged — it is capable. But the idea would be, then, to leverage GOL more.

It is very unpredictable, what would be the gold price trajectory going forward. We will wait, watch and see, and kind of keep responding to the evolving situation.

…In the current context, a little bit strain on working capital has come in. And the year-end number which you see … Akshaya Tritiya being early, there has been upstocking towards end of March. So the balance sheet number which you see is a point number, that's not the story for the full year.”

— Ashok Sonthalia, CFO, Titan

Kalyan Jewellers India | Mid cap | Jewellery

Kalyan Jewellers points to an interesting business dynamic: when gold costs are rising, it becomes much easier to up-sell studded products to a customer. A lot of the value of that piece of jewellery comes from the stone, rather than the gold — which means the higher prices are less of a problem.

“Studded conversion becomes easier when the gold price is very high.

Very simple reason: because customer comes with Rs.1 lakh, for example. If it is plain gold, he or she will end up buying 10 grams, right...

So earlier they could have bought 13-14 gram … now they are able to buy only 10 grams with the same budget. So, customer might not get the same product which was there in his mind because, volume-wise, they would have cut by around 30-35%.

But when it comes to studded, at least 40-50% is taken care by the stone. So only, the gold — rest of the gold — where this volume issue is coming. So, for studded product, the perception of the customer for what he should, he or she should buy versus what reality is will be more closer than the plain gold. So, it makes it easier to convert to studded when the prices go up.”

— T.S. Kalyanaraman Ramesh, Executive Director, Kalyan Jewellers

The company points to how 18-karat gold products are more profitable for it than pure gold, given how it largely just earns from making charges.

“... you know that our profitability is on the cost price of the product which is made and then selling price is the making charge, right? So our margin is only regarding the making charge. So we, as a percentage, we will not compromise on our making charge at all. In fact, 18 karat will have a bit more profitability than the 22 karat.”

— T.S. Kalyanaraman Ramesh, Executive Director, Kalyan Jewellers

Voltas | Mid cap | Consumer Durables

Stronger UCP margins were driven by a better product mix, with high-demand industrial air coolers, premium energy-efficient ACs, and improved commercial AC profitability.

“There are couple of things which have helped us you know increase our margins in this category. UCP as you know is consisting of air conditioners, commercial definition, commercial air conditioning and air coolers. So in each of these verticals except for the commercial definition segment we have done better than the previous quarters and the previous year in terms of our profitability uh for the several reasons. One, of course, the better product mix has happened like in air coolers. There is a you know better demand for the larger capacity industrial kind of coolers uh which is more than 100 120 L etc and which is slightly better margin fetching products. Similarly, even in the room AC category also there is a demand for higher energy efficient products which is also helping us improve our profitability and even on the commercial air conditioning front also the overall revenue and profitability has gone up in quarter 4 and this has all helped us in improving our margins.”

Management remains ambitious on growth but sees dependence on summer weather for AC/cooler sales:

“Of course we've got plans we are we intend to grow and uh that's our ambition also but it will all depend on the summer season. However, as you know these days actually you know the ACs, air coolers and all these products or you know whatever vertical we are into round the year there's been movement happening because you know somewhere and we have got you know larger basket and you know they keep complimenting if chance you know one particular category doesn't you know uh show up then the second category makes up for that.”

Voltas aims to defend leadership but acknowledges intensifying competitive pressures from global brands:

“So while you know we would aspire to go back to higher market share. However, I think we need to bear in our mind the number of players which are continuously been increasing in the category because as I said India is poised for a big growth and every geography is looking at entering into India. If you look at we have got brands from America, Europe, Korea, China, Japan from all geographies you know people have entered into India.”

Voltas received a ₹25 crore customs duty notice on copper imports under FTAs but believes its sourcing was legitimate:

“The notice demand notice was on copper as an element. If you talking about what particular item was it and since uh correct uh we have been buying you know copas as well as the industry from you know some of the countries where the uh you know duty exemptions are there FDA have been signed up we've been buying from there and probably in our opinion it's a legitimate buy because they have declared those countries have declared and they have showed up the documents also submitted documents also to that effect.”

Hester Biosciences | Small Cap | Pharmaceuticals

The extended timeline to breakeven implies continued cash drain from the African operations. With accumulated losses of approximately 45 crore as mentioned later in the call.

"We hope that not this year the next year we hope two years we should take to break even at Hester Africa because the African market as you understand is a very different market. We are one of the first rather the first to produce most of the vaccines veterinary vaccines in the continent while there are innumerable disease outbreaks it is still a matter of educating the people which we are doing reasonably well at this point of time and at the same time the tender businesses which were to come nearly two years ago but due to various slowdown activities mainly due to the geopolitical reasons these things have slowed down. Having said that we are already having the tender for Tanzanian government business we see other one or two countries also tenders coming up, so to be on the safe side we would like to say two years."

- Rajiv Gandhi, CEO and Managing Director

Management is clearly articulating a differentiated business strategy focused on diversification across animal species and moving beyond just vaccines to a more comprehensive healthcare approach.

"Coming to the poultry healthcare division, our poultry healthcare division continued positive momentum with our vaccine sales benefiting from higher demand and awareness around our Newcastle disease and Marek's disease vaccines. We also launched new feed supplements and disinfectants which are now starting to gain traction. Preparations for our avian influenza vaccine launch are progressing well, and we expect this to be a key growth driver in the coming year."

Later, in response to a question about business mix: "Our poultry business is not dependent on tenders at all, so whatever numbers we have shown are purely what we call institute or trade business because there is no government intervention as such. With respect to the animal health division, I think it's approximately 50-50, wherein the nature of the industry is such that government intervention is required in order to immunize the dairy animals and production animals. Health products are something which get sold in the trade market, and that is what our focus is this year."

She added:

"We are not an exact comparison to Venky's because Venky's is a poultry vaccine company, while our endeavor is to be a complete holistic animal healthcare company wherein we have various divisions. We don't want to be completely dependent on one division, so we have different species we address—poultry, animal, and pet care—and hopefully even more species that we can add soon."

- Priya Gandhi, Executive Director

SG Finserve | Small Cap | Finance - NBFC

This technology investment could be a key differentiator in preventing fraud and defaults as they expand - particularly important given the industry's history of challenges.

“When it comes to risk in supply chain finance, I think monitoring of cash flows on a day-to-day basis is extremely important. We are almost at the final stages of launching our AI-based monitoring tool from which we will be extracting data from the GST [Goods and Services Tax] portal on a monthly basis and capturing the sales and purchases anchor-wise, state-wise, HSNSAC [Harmonized System Nomenclature and Service Accounting Code] wise. We're also tracking the repayments done through our counter, which will help us verify that borrowers have utilized our money in the right form and repay us on time. That is the foremost risk mitigation measure we are implementing, which will help us maintain almost a monthly health checkup tracker for all our borrowers.”

- Sorabh Dhawan, CEO

Union Bank Of India | Mid Cap | Financial Services

This precise disclosure of repo-linked loan exposure (28%) provides a key metric for understanding the bank's interest rate sensitivity.

"Madam, regarding NIM [Net Interest Margin], if you're looking at it, though we have maintained and achieved the guidance which we provided of about 2.8% to 3%. As you know, because of the present market situations, we are able to minimize the effect of the margin squeeze within our bank. That's what we have been communicating—that we have been letting go of some low-yielding advances so that our margin will be maintained. We'll try to do the same going forward. We will continue to manage the margin in the coming days, especially since the cost of deposits has not come down significantly yet."

“If you look at it, the 50 bps rate cut which has happened affects only about 28% of our credit that is under the repo rates of RBI [Reserve Bank of India]. When RBI announces a rate cut, it is immediately passed on to these customers. But deposits take time to reprice, which is happening slowly. We have recently recalibrated our deposit rates and we are trying to bring down our cost of deposits, but it will take time. That's the reason why we are focusing on managing the NIM at the overall level."

The concentration of repeatedly restructured accounts in agriculture may hint at underlying stress in this segment that was previously being masked through restructuring rather than being recognized as potential NPAs.

"Regarding the elevated agri and MSME slippages this quarter, we've taken a decisive stance on a large number of repeatedly restructured accounts, particularly in agriculture. I want to emphasize this is a one-time exercise and not a continuing trend for upcoming quarters. The same approach was applied to MSME accounts. Additionally, we've fully automated our asset classification system, eliminating manual intervention. This automation implemented new classification logic that wasn't previously applied, resulting in slightly higher slippages. Again, this is specific to this quarter only."

"Yes, both agriculture and MSME segments. The repeated restructuring issue was primarily in agriculture accounts. As mentioned, we've implemented full automation of our asset classification with certain new logic parameters that weren't in place before, which has contributed to the higher slippage figures from MSME as well."

Canara Bank | Mid Cap | Financial Services

PSLC income is subject to market dynamics. While the volume of sellable loans might decrease due to regulatory changes impacting supply (as Agri Gold Loans categorized as Retail Gold Loans, therefore losing their PSL status), higher commission rates (reaching 3% recently vs <2% earlier) due to tighter supply could offset the volume decline, potentially stabilizing income from this source.

"PSLC works on demand and supply. Last year, we sold almost ₹86,000 crore in the form of PSLCs. But supply was also high because of gold loans under agriculture and other factors.

Now, due to the latest RBI regulations, there may be a reduction in the availability of priority sector loans in the market. That may impact Canara Bank—not in terms of income, but in terms of the amount we can sell.

When supply is high, the commission earned is lower. For example, in the first quarter of last year, we were getting commissions of around 1.75% to 1.9%. But towards the end of the year, the trend reversed—we earned around 2% commission for one quarter, which is quite high compared to the usual 0.4%–0.5%.

In the current quarter, rates have already touched 3%. So even if the quantum we sell comes down from ₹80,000 crore to ₹40,000 or ₹50,000 crore, our income may not fall, because demand is very high and commission rates are strong."

- Ashok Chandra, Executive Director

While overall slippage ratio improved YoY, the sequential increase was primarily driven by higher slippages in the MSME segment (Rs.1250 Cr vs typical Rs.1000 Cr), followed by Agriculture (Rs.750 Cr) and Retail (Rs.650 Cr).

“It is only the three sectors, that is MSME is 1250 [crores]. The Agriculture is 750 [crores]. The Retail is 650 [crores]. We have seen that only the earlier MSME was used to slip around 1000 crores, that has gone to the 1250 [crores]. Only that much difference is there, not much more than that.”

- Satyanarayana Raju K., MD & CEO

Chambal Fertilizers and Chemicals | Small Cap | Fertilizers

Management reveals a critical competitive advantage in crop protection: access to newly launched and superior products through strategic alliances, giving them first-mover advantage with the latest chemistries.

"You see, 70% of Indian crop protection chemical business is through generics, so only 30% is patent or niche products. But regarding product uniqueness, as Mr. Bel mentioned, because of our relationships, we're getting some products in the year of launch. We don't have to wait for 2-3 years after a product is launched elsewhere to access it - that's our uniqueness.

Secondly, depending on soil type and farmer spending behavior, we maintain a diverse portfolio. For example, for stemborers and leaf folder segments, we sell Axiom Pair chemistry, Cartap hydrochloride, and Fipronil. These are in different price bands for different soil types. This approach is common across companies, and we implement a similar strategy."

- Mr. Bel (CEO/Senior Management)

Management identifies a structural shift in global fertilizer supply dynamics, with China becoming an unreliable supplier due to domestic reprioritization of phosphoric acid toward EV battery production.

“No, I'm just saying that China, from being a very steady supplier of PNK [Phosphorus, Nitrogen, Potassium] fertilizers and even Urea to some extent, has now become an 'off and on' kind of party for the last 3 years. Their reasons are internal - they may be diverting some part of the phosphoric acid capacity into battery manufacturers for electric vehicles, or they could be doing it for geopolitical reasons. Whatever the cause, the fact is the global supply from China is now fluctuating to some extent, as opposed to them being a steadier player over the last 3-4 years.

This means that for certain types of PNK products, we have to shift our sourcing to other geographies such as Morocco, Saudi Arabia, Jordan, Russia, or even the US. The dynamics keep changing, but I am confident that overall, the supply situation in the world is steady. However, because of the geographical concentration of where the raw material is found, there are monopolies that get created, which creates problems in terms of how the trade plays out.

This is different compared to Urea or ammonia, which has a much more open market with many suppliers, so it evens out the competitive situation and gives you better negotiation capability."

- Mr. Bel (CEO/Senior Management)

Management reveals a significant shift in government policy toward DAP imports to a "cost-plus mode," making imports viable again after prior challenges.

"If I get you right, Jesh is asking what our stance on DAP imports is likely to be for Kharif season. I would say the government has made suitable adjustments and has gone to a kind of cost-plus mode. We are also participating - almost 1 lakh and 30,000 tons has been contracted to date, which includes volumes of TSP [Triple Super Phosphate] as well. Going forward, should this policy continue, we have no hesitation in increasing volumes in this area, subject of course to various geopolitical uncertainties. The facts are that we are in a somewhat uncertain situation today, but nevertheless, we feel that we will be able to surpass our volumes of last year."

- Mr. Bel (CEO/Senior Management)

Dilip Buildcon | Small Cap | Engineering - Construction

This insight reveals significant systemic risks in India's infrastructure development model that have led to the recent ordering slowdown. By drawing parallels to the 2009-11 era, which ended in widespread project failures and bank stress, management suggests the current cycle of awarding projects to underqualified bidders at unsustainably low prices was heading toward a similar crisis.

"The delay in the government ordering is best asked to them, but from whatever we have understood till now, because the last two years more than actually that, where the government saw a significant number of new players and smaller players emerging and taking larger share of HAM [Hybrid Annuity Model] projects. So they were facing challenges around financial closure of their HAM projects, they were facing challenges around even once they're getting started, because they've been bid at some really ridiculous numbers, they were seeing challenges in progress.

So I think there has been a rethink within the government that they don't want to make a repeat of the 2009-10-11 era where a lot of players came in and the government got great deals but none of those deals actually materialized. So I think there has been a rethink in the government that they don't want to have that because then it's a problem that they will have to again solve, whether it's for banks or whether it will be for the industry. And ultimately the net loser in that whole scheme is the government if they have to recapitalize the banks, if they have to solve for projects that are not done, escalated cost of projects.

So I think all of that rethinking is happening. Precisely which is where there is an improvement in the qualification criteria that they're doing now. And it's better that these projects are now going to be awarded once that qualification criteria is done."

- Rohan Suryaini, Head of Strategy and Planning

This represents a potentially significant inflection point in the competitive landscape for infrastructure projects in India. The government has reversed its previous policy of relaxed qualification criteria and is now reinstating more stringent requirements.

"One there are a couple of good things that have happened in the road sector. The government has taken notice of the challenges that they have faced because of reducing their credentials criteria for bidding of projects. They have really struggled to get projects off the ground and also have started struggling on the construction quality front.

So very recently, about a week or so ago, they have changed on the EPC model and made the criteria, eligibility criteria more stringent. Similar steps are expected in the HAM model as well. So we are expecting now that the competition should be more moderate.

If you look at last year's data, in HAM 91% of projects were won by non-recognized or the smaller players - 91%, let that sink in. And in EPC, that number is even higher. So while the government has awarded these projects at record low prices, there is definitely certain question marks on the quality and the project progress that they'll be able to achieve. Hence, they have taken these corrective measures. So we are hoping that flows in line in this financial year."

- Rohan Suryaini, Head of Strategy and Planning

Muthoot Microfin | Mid Cap | Financial Services

Management guides credit costs to normalize to 4-6% in FY25, down significantly from the 9.4% (or 7.5%

ex-overlay) reported in FY24, suggesting the bulk of stress recognition is likely complete.

"...because as you have made all the provisions right now, next year should be a—credit cost should be a steady-state number of, let's say, lower than this number, or do you expect higher credit cost earlier in the first half?"

"Yeah, Nidesh, that’s our anticipation as well. But again, as I said, the situation is still developing. Karnataka just happened in February, and we’re beginning to see the impact now. The early trends are positive, and in Tamil Nadu, there is no impact so far.

If that holds, then there shouldn't be any incremental or surprising credit costs. But since these situations are still very nascent, I wouldn't want to say that the cost will be like a normal year.

What we are guiding is a credit cost of 4% to 6% for the next financial year."

- Sadaf Sayeed, CEO

While the Karnataka legislation caused temporary collection disruption (now improving and provided for), the proposed Tamil Nadu law is seen as proactive and hasn't impacted operations yet, suggesting varied state-level regulatory impacts.

In Karnataka, a new regulation was introduced targeting certain financial entities, especially those that were previously unregulated or loosely regulated.

"In the meantime, I'm sure you’re aware that there is a legislation proposed in Tamil Nadu as well. The good part is, unlike the Karnataka legislation, the Tamil Nadu one is not based on any customer grievances—it's a proactive step by the government. As of now, there has been no disturbance in the performance of the portfolio. We’ve been able to continue collections as before, and the portfolio remains pretty stable in Tamil Nadu.

Regarding Karnataka, we’ve had instances where legislation came into place and had an impact. Even though it was directed towards unregulated entities, by the time the regulation was put in place, there was a lot of speculation, which affected collection efficiency. We have already seen a very good improvement in collection efficiency post that, but of course, our initial portfolio was impacted. We have made adequate provisions to ensure there are no uncertainties going forward."

- Sadaf Sayeed, CEO

Aarti Industries | Small Cap | Chemicals

Management provides granular insight into how US tariffs are affecting different product lines differently. The revelation about positive demand traction for specific products like MPD offers investors visibility into potential growth areas that might outperform.

"So I think the overall US tariff impact on AI [Aarti Industries] is bit mixed, right? And you know, because it is complex we have a wide variety of the product portfolio and different products have different implications because some products are part of Annexure 2, some products are not part of Annexure 2."

"In general the products where we are directly competing against China, and if they are not exempted, if they're not part of Annexure 2, then in that context of course we have a positive tailwind. And you know, likes of for example, you know, MPD [Meta-phenylenediamine] is one of the product in PDA [Phenylenediamine] chain, where, you know, in the near term we are seeing positive demand traction because it's not part of exemption and the competition was from China, so there's a clear-cut advantage."

"While there are some products which are part of exemptions, but even though they are part of exemptions, I think there's a tendency generally coming out from the market to see if they can source better volumes from India provided we are able to meet the pricing expectations."

"The second category of products, and there are a lot of products in that category, especially in the sort of agrochemical segments and life sciences. And, you know, the third category of the product is like for example MMA [Methyl Methacrylate Acrylate] where where we are not really frankly competing head-on with any particular manufacturer but it's more of a market development effort that we are doing. In that context of course tariffs have a negative impact because, you know, they straight away add cost to the product for the final customer and the economic viability does get little bit compromised because of increased cost."

Despite the end of destocking cycles, management reveals structural overcapacity issues in China are keeping agrochemical intermediate prices depressed. This indicates margin pressure may persist longer than market expectations despite volume recovery.

"I think we covered this in some of the earlier conversations. I think overall our perspective is, the inventory destocking is completed, I think there's a genuine demand-supply imbalance issue for the agrochemical intermediates and downstream technicals."

"We are seeing volume recovery for sure, but given the amount of overcapacity that exists in China, that incremental volume growth is also served by marginal pricing, and that's where we are not seeing uptick on pricing/margins at this stage."

"Going forward, especially with the US tariffs announcements, there are some movements happening in the overall agrochemical value chains, and we expect at least from a downstream product flowing to US point of view, there should be positive traction. And in that context, the requirement of intermediates from for our domestic customers is expected to go up, so this should benefit."

- Suresh Kotecha, Executive Director and CEO

Escorts Kubota | Mid Cap | Auto

The management provides unusually specific and confident guidance about the tractor industry reaching "the highest ever volume" potentially hitting 10 lakh units.

"So on the industry side as I said, we're expecting a growth. So you can actually look at a mid to high single-digit growth this year. So this is for sure that the industry is looking at the highest ever volume in the Indian tractor market this year and if all things fall into place we are probably looking at a 10 lakh number this year. It's quite possible because all the factors that impact the industry, the forecasts for the rains have been good initial forecast and all the other factors, the government focus on agriculture in everything is positive. So we are actually looking at the highest ever industry this fiscal year."

"Uh now your second question was regarding emission norms. So emission norms - we, the earlier date was 1st April 2026. We do not see as of now the norms getting implemented on that date as of now."

- Nikhil Nanda, COO (Tractor Business)

Management reveals a major strategic shift in Kubota's global manufacturing strategy, with plans to make India a global production hub for both basic and high-end tractors.

“Mexico will start now. I think it's already started. The distributor which was a common distributor for Kubota and us, so that started working. So we'll see the numbers will start coming in from this quarter. So US market is where we thought which is a bigger market but now I think obviously there's some impact on the tariffs unless we see a stability coming in post some sort of negotiation and agreement on that. But in the long term I think that's one market which will really work for us and you heard from, I think Kubota globally has also talked about they're using India as a major hub for supplies to the world market for Kubota. So they are working on a larger plan.

So all the basic tractors they want to shift to basic and high end also they want to shift to India. So that's the strategy what Kubota is working on. Uh and I think we had mentioned in the last call also there's a midterm business plan which is being reworked now. So obviously Kubota in view of this new strategy now is taking some time and they expect their strategy will get approved sometime I think the first cut will get approved maybe by middle of this year and then by end of last quarter or middle of last quarter of this fiscal they will be clearing it from the board. So once that gets done then obviously we'll put it into our plan and we'll also then make it public."- Bharat Madan, Director and CFO

Housing and Urban Development Corporation | Mid Cap | Financial Services

The CMD provides important context on MOUs that helps investors appropriately value HUDCO's business development pipeline. By clarifying that MOUs are "first steps" rather than sanctioned projects and typically cover a 5-year horizon, he sets realistic expectations about conversion timelines.

“MOU doesn't mean that the projects are sanctioned. So it is the first step towards the understanding that HUDCO will be the partnering lending agency for funding these kind of projects. So there may be some time because some projects may come in first year then second year and then the third years. These MOUs are generally for next five years of the time.

"And number two you had told that three lakh is very optimistic and looking at the 10 trillion economy you are very right because these numbers were we had calculated last year, last financial year or before last financial year. So still we are keeping these three lakh crores because we have to see our CAR [Capital Adequacy Ratio] and debt equity ratio and all the financial ratios. But yes definitely looking at the opportunity we need to revise this number, but I think the time of revision is still to come and there are so many things which are opening up from the government of India side also and now we are into the era of urban reforms and a lot of things we are working with our ministry including how to come out with this program of urban challenge fund. So all these things will are the potential business development programs as far as HUDCO is concerned. So I think maybe in next financial year if the things unfold we may be working out some figures more than this three lakh crores, but as of now we will keep our three lakh crores."

- Sanjay Kushra, Chairman and Managing Director

Apcotex Industries | Small Cap | Rubber Products

The management provides critical insight into how US tariff policies are reshaping global trade flows in their industry. Chinese manufacturers are redirecting both finished gloves and raw latex to non-US markets, potentially creating pricing pressure in Apcotex's key export markets including Europe and Asia.

“Obviously the difference between last time and this time is that last time it was specifically—I mean last time when we met in January, it was specifically on Chinese gloves that the US had imposed 50% duty starting Jan 1st. Now what's changed dramatically was on April—this was since early April—is that tariffs were announced across the board and then, you know, reverted back, and now obviously only China has more than 100%—I don't even know the number anymore; it keeps changing—but more than 100% tariffs on all products from what I understand.

So as a result of which, of course, the Chinese glove industry has been affected and what we are seeing is that what we are hearing from our customers is that now China is—it's not viable for them to supply to the US. They're, you know, coming to all Europe and Asia and other parts of the—they're seeing more Chinese gloves hit those markets. And similarly on the latex as well, because their overall glove—what I understand—glove industry has been affected in China, they have excess latex, so that's also coming out of China and we are seeing it in some markets."

This statement reveals a critical aspect of Apcotex's business model that investors may overlook: the company focuses on maintaining a consistent delta (margin) between raw material costs and selling prices rather than benefiting directly from crude price movements.

“Historically we have seen in the short term it's not so beneficial because when prices fall so sharply, we are, you know, we are left with some inventory, both finished goods and raw material, and that's going to be the challenge really this quarter in Q1 because as you've seen that, you know, compared to March end to now, crude oil has really fallen around. It's I think it's Brent crude is almost $60, a little over that, but around that versus it was, you know, over $80 perhaps a couple of months ago.

So in the long term, of course, we—I think we all prefer lower oil prices. It does help more about the margins.”

"Absolutely. And honestly, the crude prices for us, you know, unlike maybe FMCG [Fast-Moving Consumer Goods] companies that are using crude as a base—or FMCG is the wrong word, but any company where—yeah, you know, where—I don't think for—okay, let me put it this way. I don't think crude prices in the long term affect us too much, whether they're up or down. We obviously prefer them lower than higher. But but in general, it's about the the margin between our raw material prices and the finished goods prices.

So being a B2B [Business-to-Business] company, we have to move quickly and reduce and increase prices as the raw material prices go up and down, because we have a delta that we focus on."

ZEE Entertainment | Small Cap | Media & Entertainment

Re-entering the Free-To-Air (FTA) market is a significant strategic move expected to contribute to achieving the FY26 revenue growth targets.

Free-to-Air (FTA) refers to television channels that viewers can access without paying subscription fees. Essentially, these channels are broadcast openly, and viewers only need a basic antenna or cable connection—no extra monthly charge applies. The primary source of revenue for these channels typically comes from advertisements, rather than from subscription fees.

“So Mr. Parekh, I think there are two aspects to this. One being our re-entry into the FTA space, which did not exist last year. So, that is a completely new segment of free-to-air where we've re-entered. That should help us to get some part of this achieved. And then also our aspirations with, as I spoke in my opening remarks about the mini-series and what we intend to do with ZEE5, etc., will aid this growth factor that we are looking for.”

- Punit Goenka, CEO

Management's openness to an out-of-court settlement in the Star arbitration case could lead to an earlier

resolution and remove a significant overhang on the stock.

The ZEE-Star case is a legal dispute over a failed $1.4 billion sub-licensing deal for ICC cricket broadcasting rights, with Star accusing ZEE of breaching payment terms and ZEE countering with claims of unmet conditions.

"Now that the merger between Jio and Star is completed, and you are now dealing with a different party—

Is there a possibility of an out-of-court settlement approach here? And if so, what could be the financial implications of that strategy?"

"So, it's very early days, but we are open to all possibilities available to us—both legal and non-legal, including out-of-court settlements. But it’s too early for us to comment on that at this stage."

"No, that’s it. That’s pretty much what PG has said. It’s still a long way to go before we know the outcome, but as PG mentioned, we are definitely open and are working on deploying all strategies—legal and non-legal."

- Punit Goenka, CEO

Management anticipates the Jio-Star merger will eventually have a positive impact on advertising rates for the entire industry, including ZEE. It is also leading to more favorable terms for ZEE in acquiring content, potentially improving cost structures.

"I think on the first part, on the advertising front, it's still very early days, Aditya. But I do expect that eventually it will have a positive impact on the overall industry. So let’s hope for the best. As I said in my opening remarks, I’m an optimist, so I expect this will benefit us as well.

We are already seeing a lot of benefit coming through on the acquisition of content—probably not on production yet, because production is a commoditized business where we work with multiple suppliers. But on the acquisition side—whether it’s for films or the OTT business—we are already beginning to see real benefits flowing through for the entire industry."

- Punit Goenka, CEO

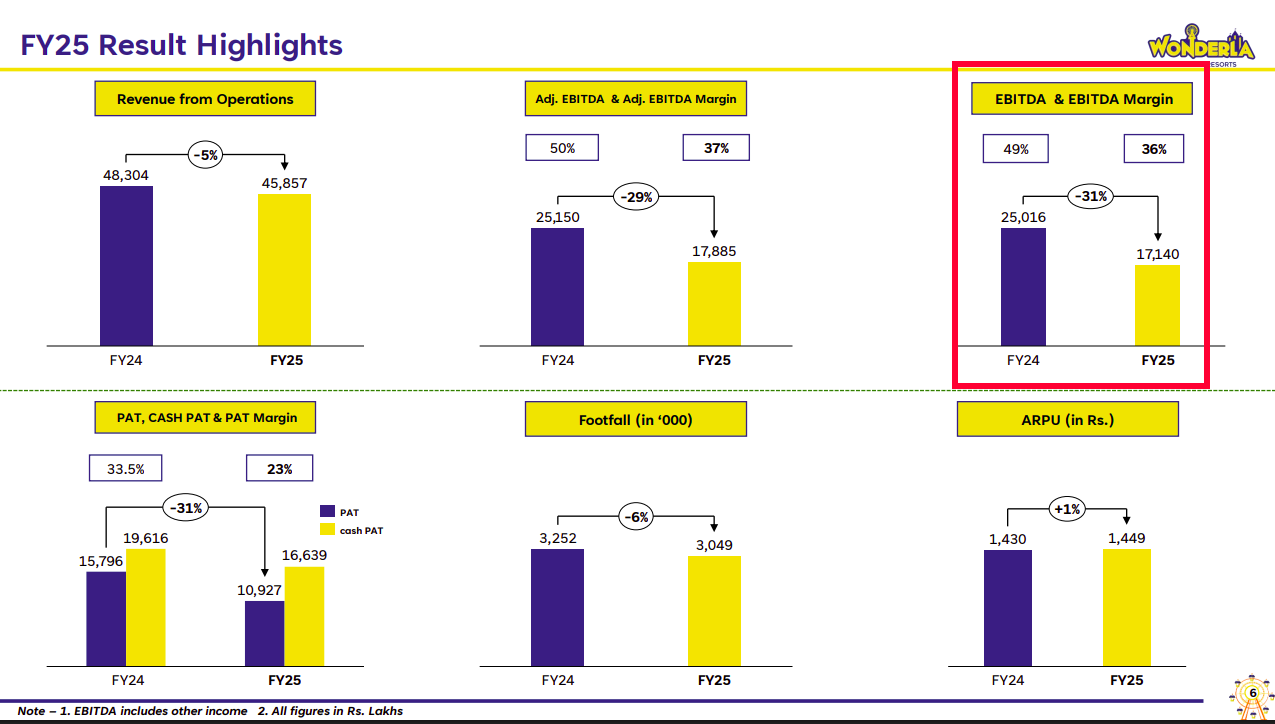

Wonderla Holidays | Small Cap | Media & Entertainment